Bitcoin has transcended its early reputation as a fringe digital currency to become a cornerstone of the evolving global financial system. What began as an experiment in decentralized money has matured into a significant economic force that’s reshaping how we think about value, investment, and financial sovereignty. As central banks continue printing money and inflation erodes purchasing power, Bitcoin’s fixed supply and decentralized nature offer a compelling alternative to traditional financial assets.

Bitcoin’s evolution from digital currency to global financial asset

In this comprehensive analysis, we’ll explore how Bitcoin is positioning itself as a global economic powerhouse, examine its maturation into the mainstream financial system, and look beyond the hype to understand its practical applications. Whether you’re a seasoned investor or simply curious about the future of money, understanding Bitcoin’s trajectory is essential for navigating the changing financial landscape.

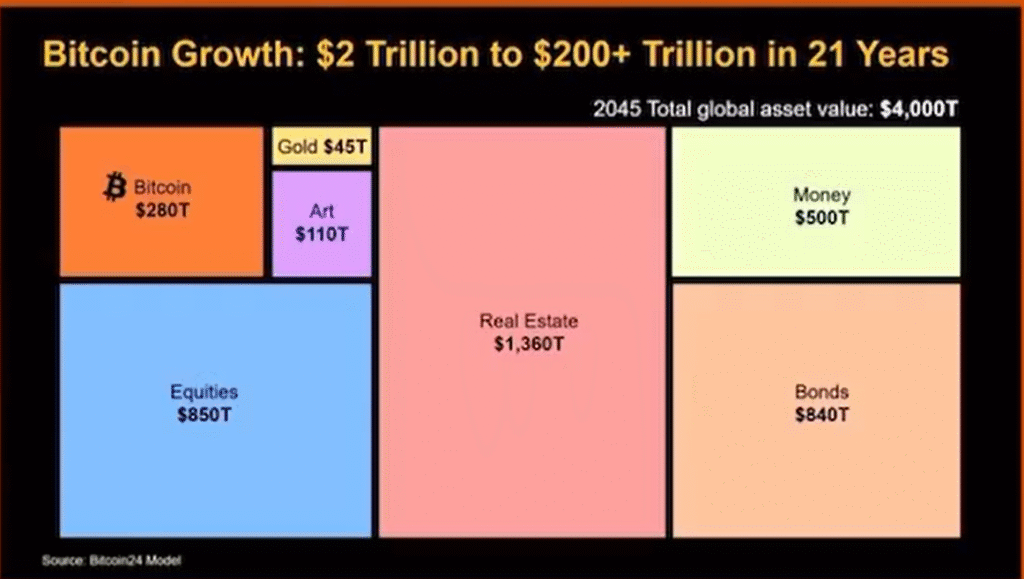

Bitcoin as a Global Economic Powerhouse

Bitcoin’s performance compared to traditional inflation hedges

A New Hedge for a Turbulent World

In an era of unprecedented money printing and rising inflation, Bitcoin’s fixed supply of 21 million coins stands in stark contrast to the endless expansion of fiat currencies. Unlike dollars, euros, or yen, which can be created at will by central banks, Bitcoin operates on a predetermined issuance schedule that becomes increasingly restrictive over time through its “halving” events.

This scarcity mechanism has positioned Bitcoin as digital gold—a hedge against monetary debasement. However, Bitcoin offers several advantages over its physical predecessor. It’s infinitely divisible, easily transferable across borders, and impossible to counterfeit. These properties make Bitcoin not just a store of value, but potentially a superior one.

“Bitcoin is the first scarce digital object the world has ever seen. It’s scarce like silver and gold, and can be sent over the internet, radio, satellite, etc.” – Michael Saylor, MicroStrategy CEO

Countries experiencing severe inflation, such as Argentina and Turkey, have seen grassroots Bitcoin adoption accelerate as citizens seek protection from rapidly devaluing national currencies. This real-world application demonstrates Bitcoin’s utility beyond speculation—it’s becoming a financial lifeline in economically distressed regions.

The Rise of the Bitcoin Balance Sheet

Perhaps the most significant shift in Bitcoin’s financial future has been its adoption by corporate treasuries. Led by Strategy, which has acquired over 568,000 BTC, public companies are increasingly viewing Bitcoin as a strategic reserve asset rather than a speculative investment.

Major corporations and their Bitcoin treasury holdings

This corporate adoption reflects a fundamental reassessment of Bitcoin’s role in the financial system. Rather than viewing it as a risky digital token, these companies see Bitcoin as a hedge against inflation and currency devaluation—a way to protect shareholder value in an uncertain monetary environment.

The approval of Bitcoin exchange-traded funds (ETFs) in early 2024 further legitimized this approach by providing institutional investors with regulated vehicles to gain Bitcoin exposure. This development has opened the floodgates for pension funds, endowments, and other conservative institutions to allocate capital to Bitcoin within their existing investment frameworks.

Uncertain about Bitcoin’s role in your investment strategy?

Our AI-powered advisory service can help you understand how Bitcoin fits into your financial future and develop a personalized strategy aligned with your goals.

Challenging the King of Assets: Real Estate

For generations, real estate has been considered the ultimate store of value and wealth-building vehicle. However, Bitcoin is beginning to challenge this dominance by offering similar scarcity benefits without the drawbacks of physical property.

Bitcoin’s emergence as “pristine collateral” is particularly noteworthy. Its 24/7 market, perfect auditability, and inability to be counterfeited make it an ideal base asset for loans and other financial products. This quality is drawing capital that might otherwise flow into real estate, potentially reducing the “monetary premium” that property has traditionally commanded.

Generational shift in asset preferences

This shift is particularly pronounced among younger generations, who view digital assets as more aligned with their increasingly digital lives. Unlike their parents and grandparents, millennials and Gen Z don’t necessarily equate physical ownership with security or value. For them, Bitcoin’s borderless nature and resistance to censorship represent a form of financial freedom that traditional assets can’t match.

Maturing into the Mainstream

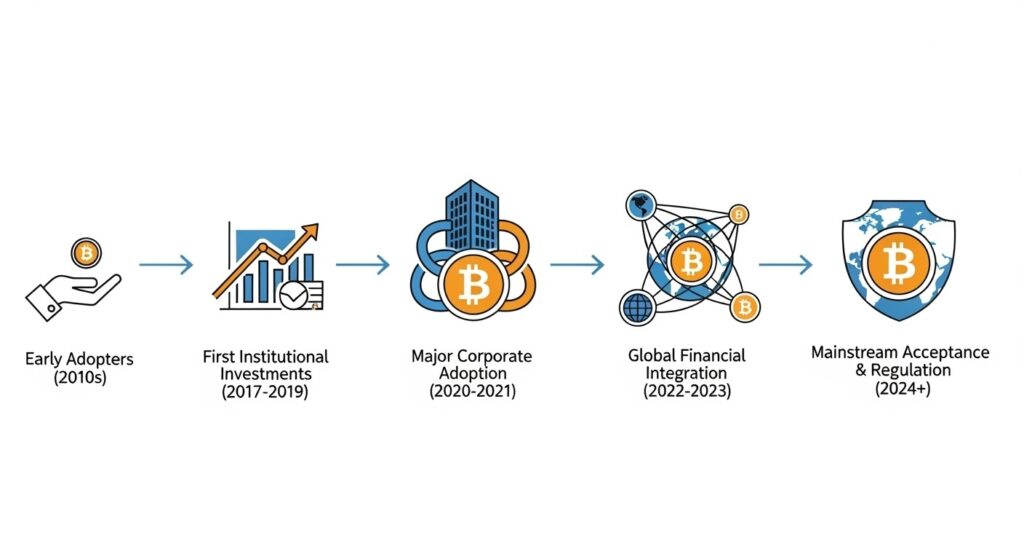

From Speculation to Strategy: The Role of Institutions

Bitcoin’s early years were characterized by retail speculation and extreme volatility. However, the entrance of institutional investors has fundamentally changed market dynamics. Major financial firms like BlackRock, Fidelity, and JPMorgan now offer Bitcoin-related products and services, bringing stability and legitimacy to what was once considered a fringe asset.

Timeline of institutional Bitcoin adoption

This institutional involvement has created a “supply compression” effect. As more Bitcoin is locked up in long-term holdings by corporations and investment funds, the available supply for trading diminishes. This dynamic, combined with Bitcoin’s algorithmically limited issuance, creates upward pressure on price over time.

The market is also becoming more resilient to large-scale sell-offs. In previous cycles, panic selling could trigger cascading liquidations and dramatic price crashes. Today, with deeper liquidity and more sophisticated market participants, Bitcoin has demonstrated increased stability—though still with higher volatility than traditional assets.

The Regulatory Green Light

Regulatory clarity has been a crucial factor in Bitcoin’s maturation. The approval of Bitcoin ETFs in the United States marked a watershed moment, signaling that regulators are increasingly comfortable with Bitcoin as a legitimate asset class.

Global regulatory landscape for Bitcoin

In the United States, the introduction of the GENIUS and CLARITY Acts has provided a framework for cryptocurrency regulation that balances innovation with consumer protection. Similarly, the European Union’s Markets in Crypto-Assets (MiCA) regulation has established clear guidelines for crypto businesses operating within the bloc.

This regulatory progress has reduced uncertainty for businesses and investors, allowing for more confident capital allocation to the Bitcoin ecosystem. As regulatory frameworks continue to evolve, Bitcoin’s integration into the traditional financial system is likely to accelerate.

Navigating the evolving regulatory landscape requires specialized knowledge. Our advisory team stays current on global Bitcoin regulations to help you make informed decisions.

Governments Joining the Reserve Club

Perhaps the most surprising development in Bitcoin’s financial future is the emergence of national Bitcoin reserves. El Salvador made history in 2021 by adopting Bitcoin as legal tender, but the trend has expanded beyond small nations.

In early 2025, the U.S. government announced the establishment of a Strategic Bitcoin Reserve, positioning Bitcoin at the heart of national economic policy. This move, coupled with similar initiatives in other countries, signals a fundamental shift in how governments view digital assets.

Countries adopting Bitcoin as reserves or legal tender

The German government’s experience offers a cautionary tale for nations hesitating to embrace Bitcoin. After seizing Bitcoin in criminal investigations years ago, German authorities missed out on billions in potential gains by not understanding the asset’s long-term value proposition. This lesson hasn’t been lost on forward-thinking governments, which are increasingly exploring Bitcoin allocation strategies.

Want to stay ahead of Bitcoin’s institutional adoption?

Our weekly newsletter provides expert analysis on how institutional moves affect Bitcoin’s financial future and what it means for individual investors.

Beyond the Hype: Practicality and the Path Forward

Store of Value or Medium of Exchange? A Tale of Two Layers

A persistent debate in the Bitcoin community centers on its primary function: is Bitcoin digital gold (store of value) or digital cash (medium of exchange)? This question has significant implications for Bitcoin’s financial future.

Bitcoin’s dual function in the financial ecosystem

The emerging consensus suggests that Bitcoin can serve both functions through a multi-layered architecture. The base layer (Layer 1) prioritizes security, decentralization, and immutability—making it ideal as digital gold. Meanwhile, Layer 2 solutions built on top of Bitcoin can optimize for speed and low fees, enabling practical everyday transactions.

This layered approach mirrors the evolution of the traditional financial system, where different layers serve different purposes. Just as gold once served as the base layer with paper money built on top, Bitcoin can function as digital gold with more efficient payment layers built above it.

Bitcoin Layer 1: Digital Gold

- Maximum security and decentralization

- Immutable transaction record

- Fixed supply of 21 million coins

- Global settlement layer

- Resistant to censorship and control

Bitcoin Layer 2: Digital Cash

- Fast transaction processing

- Minimal or zero fees

- Scalable to millions of transactions

- Suitable for everyday purchases

- Compatible with existing payment systems

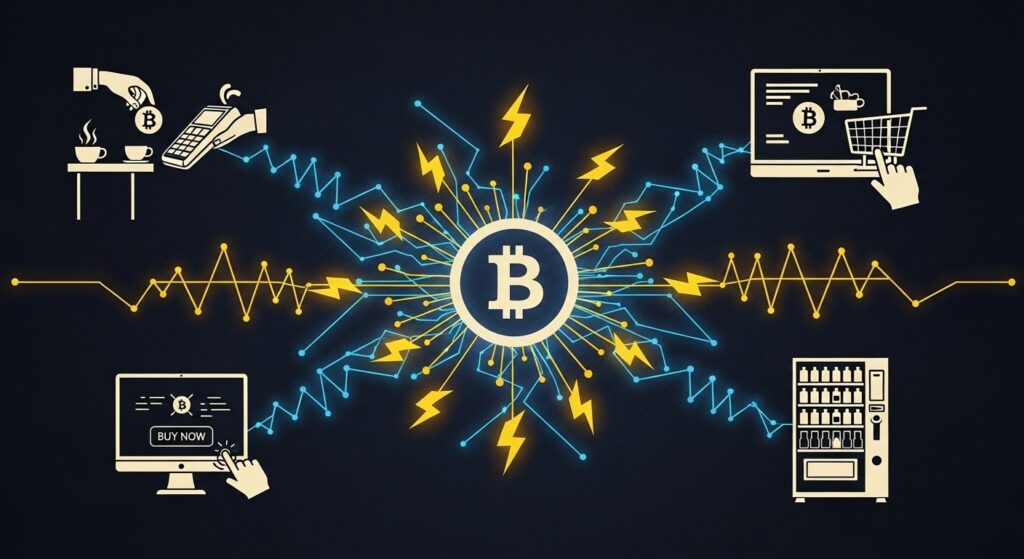

How Layer 2 is Making Bitcoin Usable

The Lightning Network has emerged as the most promising Layer 2 solution for Bitcoin. By creating payment channels between users, Lightning enables near-instant transactions with negligible fees, addressing Bitcoin’s scalability challenges without compromising the security of the base layer.

Lightning Network growth and adoption metrics

Major companies have recognized Lightning’s potential. Coinbase, Cash App, and Strike have all integrated Lightning functionality, allowing millions of users to send Bitcoin instantly and cheaply. This corporate adoption is crucial for Lightning’s growth, as it provides the network effects necessary for widespread usage.

Real-world applications are already emerging. In El Salvador, small businesses use Lightning for daily transactions, while global remittance companies are leveraging it to reduce the cost of international money transfers. As Lightning continues to mature, Bitcoin’s utility as a medium of exchange will likely expand alongside its store of value properties.

The Lightning Network processed over 1.5 million transactions per day in 2025, with an average fee of less than $0.01 per transaction—making it more efficient than traditional payment networks for small payments.

Real-world Bitcoin payment applications through Lightning Network

Beyond Lightning, other Layer 2 solutions and sidechains are expanding Bitcoin’s capabilities. Technologies like Liquid Network enable features such as confidential transactions and the issuance of digital assets, while still anchoring their security to Bitcoin’s base layer.

Ready to secure your Bitcoin for the long term?

Our advisory team can help you implement proper self-custody solutions, including multi-signature setups and hardware wallet integration.

Navigating Risks in Bitcoin’s Financial Future

While Bitcoin’s trajectory appears promising, prudent investors must acknowledge and prepare for potential risks. Understanding these challenges is essential for developing a balanced perspective on Bitcoin’s financial future.

Key risks and challenges in Bitcoin’s financial landscape

Regulatory Uncertainty

Despite progress, regulatory frameworks for Bitcoin remain incomplete in many jurisdictions. Sudden regulatory changes could impact Bitcoin’s accessibility, taxation, or legal status. Countries like China have demonstrated how government policy can significantly affect the Bitcoin ecosystem through mining bans and trading restrictions.

However, this risk diminishes as Bitcoin becomes more institutionalized. With major financial players now involved, there are powerful stakeholders advocating for sensible regulation rather than prohibition. The trend toward regulatory clarity is likely to continue, though not without occasional setbacks.

Technological Challenges

Bitcoin’s security model has proven robust over more than a decade, but it isn’t immune to technological risks. Quantum computing advancements could theoretically threaten Bitcoin’s cryptographic foundations, though the Bitcoin protocol can be upgraded to quantum-resistant algorithms if necessary.

Scaling challenges also persist despite Layer 2 solutions. As adoption grows, ensuring that Bitcoin remains accessible to users worldwide without compromising decentralization will require ongoing innovation and careful protocol governance.

Self-custody of Bitcoin carries significant responsibility. Without proper security measures and backup procedures, users risk permanent loss of their assets. Professional guidance can help mitigate these risks.

Market Volatility and Competitive Threats

While Bitcoin’s volatility has decreased as the market matures, it remains more volatile than traditional assets. Investors must be prepared for significant price fluctuations, even as the long-term trend has been upward.

Competition from other cryptocurrencies and central bank digital currencies (CBDCs) also presents challenges. Though Bitcoin’s first-mover advantage and network effects provide significant protection, innovation in the broader cryptocurrency space could potentially erode Bitcoin’s dominance in specific use cases.

Bitcoin volatility compared to traditional assets (2015-2025)

Despite these risks, Bitcoin’s fundamental value proposition remains strong. Its decentralized nature, fixed supply, and growing network effects provide resilience against many challenges. For investors, understanding these risks is not a reason to avoid Bitcoin, but rather to approach it with appropriate risk management strategies.

Strategic Approaches to Bitcoin’s Financial Future

As Bitcoin continues to mature, investors are developing more sophisticated strategies to capitalize on its potential while managing its unique risks. These approaches range from simple accumulation to complex financial structures.

Bitcoin investment strategies across different risk profiles

Dollar-Cost Averaging: The Foundation

Dollar-cost averaging (DCA)—regularly purchasing small amounts regardless of price—has proven effective for navigating Bitcoin’s volatility. This strategy removes the stress of timing the market and has historically outperformed most attempts at trading Bitcoin’s price movements.

Many institutional investors have adopted variations of this approach, systematically allocating to Bitcoin on a fixed schedule. This methodical accumulation reflects a long-term belief in Bitcoin’s value proposition rather than short-term price speculation.

Self-Custody and Security

As Bitcoin holdings grow in value, security becomes paramount. The adage “not your keys, not your coins” emphasizes the importance of self-custody—controlling the private keys that secure your Bitcoin rather than relying on third-party custodians.

Bitcoin self-custody security best practices

Advanced security setups like multi-signature wallets require multiple keys to authorize transactions, providing protection against both external threats and single points of failure. For significant holdings, these sophisticated security models are becoming standard practice among knowledgeable Bitcoin investors.

“Bitcoin self-custody is not just about security—it’s about embracing the fundamental value proposition of Bitcoin: financial sovereignty without intermediaries.”

Bitcoin in a Diversified Portfolio

Institutional investors typically approach Bitcoin as part of a diversified portfolio, with allocation sizes reflecting its higher risk profile. Research from major investment firms suggests that even small Bitcoin allocations (1-5%) can significantly enhance portfolio returns without dramatically increasing overall risk.

This portfolio approach recognizes Bitcoin’s unique properties—particularly its low correlation with traditional assets during normal market conditions. However, during liquidity crises, Bitcoin has sometimes moved in tandem with risk assets, highlighting the importance of thoughtful position sizing.

| Investor Profile | Suggested Bitcoin Allocation | Primary Strategy | Security Approach |

| Conservative | 1-3% | Dollar-cost averaging | Regulated custody solution |

| Moderate | 3-7% | Strategic accumulation | Basic self-custody |

| Growth-oriented | 7-15% | Value averaging | Multi-signature setup |

| Aggressive | 15%+ | Strategic positioning | Advanced multi-signature |

As Bitcoin’s financial future unfolds, these investment strategies will continue to evolve. The most successful investors will likely be those who combine a deep understanding of Bitcoin’s fundamentals with disciplined risk management and appropriate security practices.

Develop your personalized Bitcoin strategy

Our AI-powered advisory services can help you create a Bitcoin investment approach tailored to your risk tolerance, time horizon, and financial goals.

The Road Ahead: Bitcoin’s Financial Future

As we look toward the horizon of Bitcoin’s development, several key trends are likely to shape its financial future. These developments will determine not just Bitcoin’s price trajectory, but its role in the global economic system.

Key trends shaping Bitcoin’s financial future

Continued Institutional Integration

The institutional adoption of Bitcoin is still in its early stages. As regulatory clarity improves and financial infrastructure matures, we can expect more conservative institutions—including pension funds, insurance companies, and sovereign wealth funds—to allocate capital to Bitcoin.

This institutional wave will likely bring more sophisticated financial products built around Bitcoin, from yield-generating strategies to Bitcoin-backed loans and mortgages. The integration of Bitcoin into traditional financial services will make exposure more accessible to mainstream investors while potentially reducing volatility.

Technological Evolution

Bitcoin’s base protocol evolves slowly by design, prioritizing security and stability over rapid innovation. However, development continues on both the core protocol and Layer 2 solutions.

The Lightning Network is expected to see continued growth and refinement, with improved user interfaces making it more accessible to non-technical users. Other technological developments, such as Taproot and potential future upgrades, will expand Bitcoin’s capabilities while maintaining its fundamental properties.

Bitcoin technological development roadmap

Global Adoption Patterns

Bitcoin adoption is likely to follow different patterns across regions. In developed economies with stable currencies, Bitcoin may continue to function primarily as an investment asset and inflation hedge. In countries with weaker currencies or restrictive capital controls, its utility as an alternative monetary system may drive adoption.

The expansion of internet access and mobile banking in developing regions will bring Bitcoin to previously underserved populations. This grassroots adoption could accelerate as user interfaces improve and educational resources become more widely available.

“The countries that will thrive in the future are the ones that embrace Bitcoin—not just as an asset, but as a technology that enables financial freedom and innovation.”

Long-Term Price Projections

While short-term price predictions are notoriously unreliable, long-term models based on Bitcoin’s scarcity and adoption curves suggest significant upside potential. Stock-to-flow models, which measure Bitcoin’s scarcity relative to its production rate, have historically provided a framework for understanding Bitcoin’s long-term value proposition.

As Bitcoin’s supply continues to diminish through halvings while demand potentially increases through institutional adoption, the economic forces suggest continued appreciation over multi-year timeframes—though with significant volatility along the way.

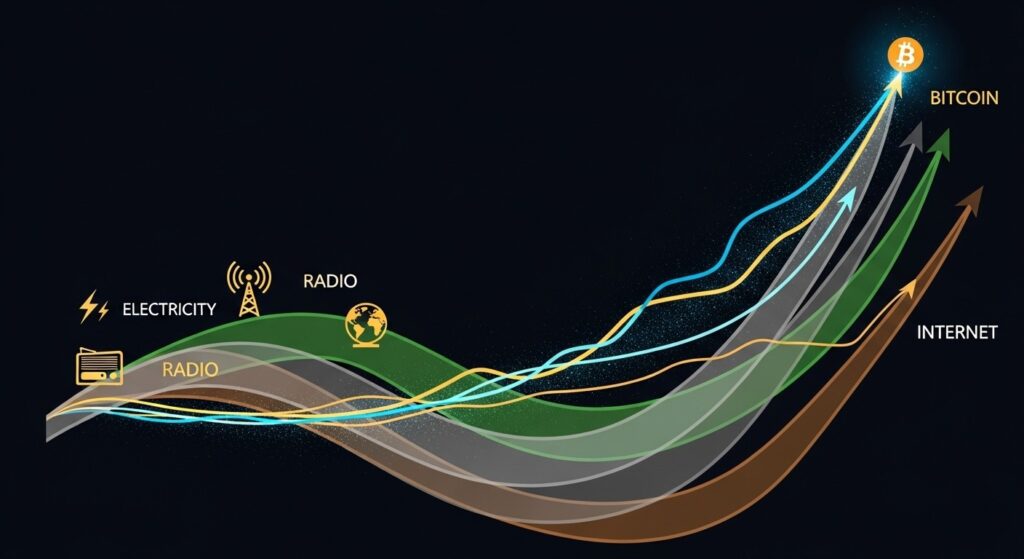

Bitcoin adoption curve compared to other transformative technologies

Ultimately, Bitcoin’s financial future will be determined by its continued ability to fulfill its core value proposition: providing a decentralized, censorship-resistant, and scarce digital asset in a world of increasing monetary expansion and financial surveillance. As long as these fundamental needs exist, Bitcoin’s role in the global financial system is likely to grow.

Conclusion: Embracing Bitcoin’s Financial Future

Bitcoin has evolved from a niche digital experiment to a significant force in the global financial landscape. Its journey from digital curiosity to corporate treasury asset and potential national reserve currency reflects a fundamental shift in how we perceive and interact with money.

Bitcoin’s evolution from whitepaper to global financial cornerstone

As an inflation hedge, Bitcoin offers a compelling alternative to traditional stores of value, with its fixed supply providing a stark contrast to the unlimited printing of fiat currencies. As a corporate treasury asset, it provides companies with a potential hedge against currency debasement and monetary uncertainty. And as a technological platform, Bitcoin’s layered architecture enables both secure value storage and efficient payments.

The institutional adoption of Bitcoin continues to accelerate, with regulated investment vehicles making exposure more accessible to traditional investors. Simultaneously, regulatory frameworks are maturing, providing the clarity necessary for broader integration into the financial system.

While challenges remain—from regulatory uncertainty to technological limitations—Bitcoin’s fundamental value proposition remains strong. Its decentralized nature, fixed supply, and growing network effects provide resilience against many potential threats.

For individuals navigating this evolving landscape, education and security are paramount. Understanding Bitcoin’s role in the financial system and implementing appropriate custody solutions are essential steps for anyone looking to participate in its future.

Ready to secure your place in Bitcoin’s financial future?

Our team of experts can help you develop a comprehensive strategy for Bitcoin investment and security, tailored to your unique financial situation and goals.

As we look ahead, Bitcoin’s financial future appears increasingly integrated with the broader economic system—not as a replacement for all existing structures, but as a powerful alternative that introduces choice, transparency, and individual sovereignty to a financial world long dominated by centralized institutions.

Whether you’re a seasoned Bitcoin investor or just beginning to explore its potential, understanding these trends is essential for navigating the changing financial landscape. Bitcoin’s story is still being written, and its most significant chapters may lie ahead.

Frequently Asked Questions About Bitcoin’s Financial Future

How does Bitcoin’s fixed supply protect against inflation?

Bitcoin has a capped supply of 21 million coins, with new Bitcoin issuance decreasing over time through “halving” events. Unlike fiat currencies that can be printed indefinitely by central banks, Bitcoin’s supply cannot be expanded, making it resistant to inflation. This scarcity mechanism means that as demand increases while supply remains fixed, Bitcoin’s purchasing power has the potential to increase over time, providing a hedge against the devaluation of traditional currencies.

What role do institutional investors play in Bitcoin’s financial future?

Institutional investors bring legitimacy, stability, and significant capital to the Bitcoin market. Their involvement has transformed Bitcoin from a speculative asset to a recognized financial instrument. As major corporations, investment firms, and potentially governments continue to allocate capital to Bitcoin, they create a foundation of long-term holders that reduces available supply and potentially stabilizes price volatility. Institutional adoption also drives improvements in market infrastructure, regulatory frameworks, and financial products built around Bitcoin.

How does the Lightning Network impact Bitcoin’s utility?

The Lightning Network is a Layer 2 solution built on top of Bitcoin that enables fast, low-cost transactions without compromising the security of the base layer. By creating payment channels between users, Lightning allows for near-instant settlements with minimal fees, making Bitcoin practical for everyday transactions and micropayments. This technology addresses Bitcoin’s scalability challenges, potentially enabling it to function both as a store of value (on the base layer) and as a medium of exchange (on Lightning), significantly expanding its utility in the global financial system.

What are the biggest risks to Bitcoin’s financial future?

Key risks include regulatory uncertainty, as governments could implement restrictive policies that limit Bitcoin’s accessibility or utility. Technological challenges, such as potential quantum computing threats to cryptography, represent another risk category. Market risks include continued volatility and competition from other cryptocurrencies or central bank digital currencies. However, Bitcoin’s decentralized nature, growing adoption, and proven resilience over more than a decade provide significant protection against many of these risks, particularly as the ecosystem matures.

How can I securely store Bitcoin for the long term?

Secure long-term Bitcoin storage typically involves self-custody using hardware wallets that keep private keys offline and protected from potential hacking. For significant holdings, multi-signature setups requiring multiple keys to authorize transactions provide additional security. Proper backup procedures for recovery phrases (seed words) are essential, often involving metal backups resistant to fire and water damage. Cold storage solutions that never connect to the internet offer the highest security level. For those uncomfortable with self-custody responsibility, regulated custody services with strong security practices and insurance can be an alternative.