Taproot Assets on Bitcoin: Transforming Bitcoin into a Multi-Asset Network

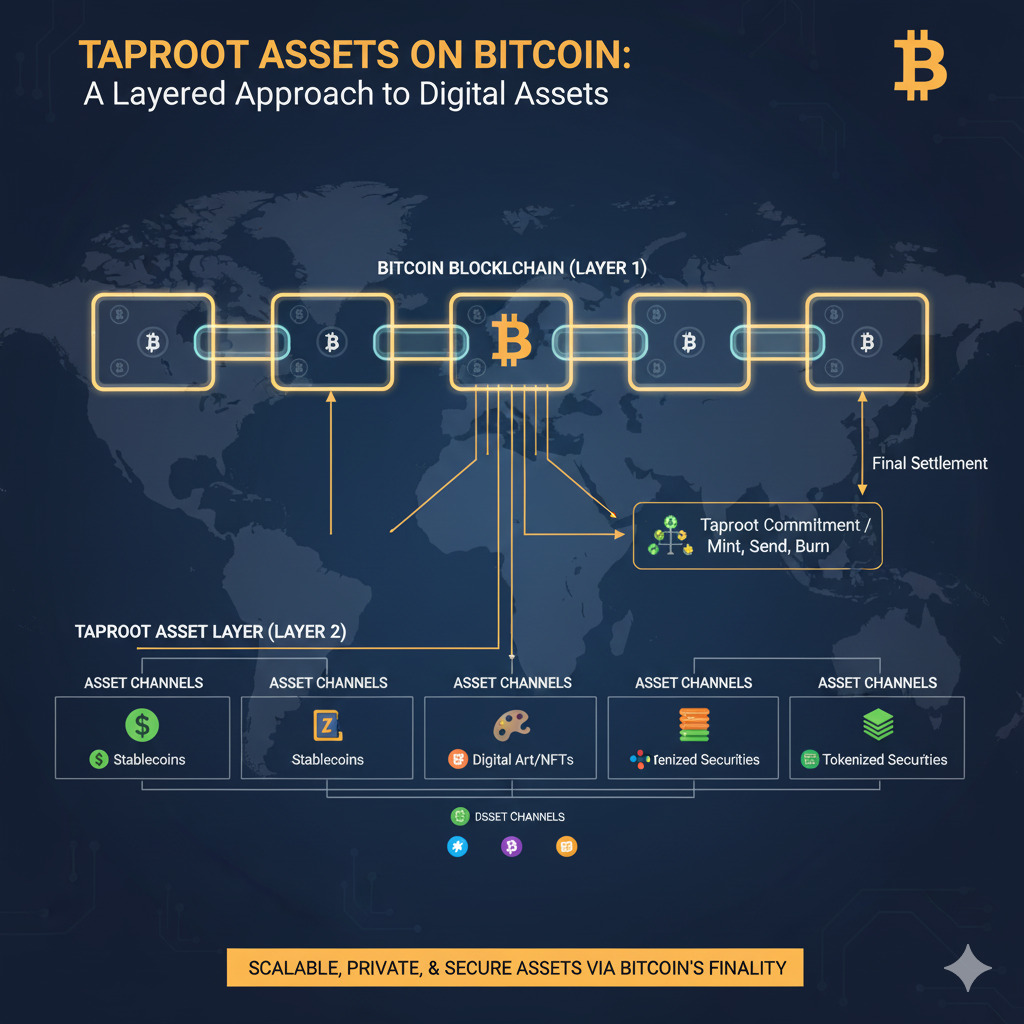

Taproot Assets represents a significant evolution in Bitcoin’s capabilities, enabling the issuance of digital assets directly on the world’s most secure blockchain. This protocol leverages Bitcoin’s Taproot upgrade to create a scalable framework for tokens while maintaining the network’s foundational security and decentralization principles. As major players like Tether begin integrating their stablecoins via this […]

Taproot Assets on Bitcoin: Transforming Bitcoin into a Multi-Asset Network Read More »