The Bitcoin network’s computing power now exceeds 500 times the combined power of the world’s top supercomputers. This massive computational force secures the most valuable cryptocurrency network in existence. But who’s behind this power, and can you still participate? This guide explores Bitcoin mining across all scales—from warehouse-sized operations to the dedicated enthusiast mining from home.

What Is Bitcoin Mining?

Bitcoin mining is like a global, decentralized lottery where computers compete to validate transactions and earn newly minted bitcoin. Miners use specialized hardware to solve complex cryptographic puzzles through a process called proof-of-work (PoW). The first miner to find a valid solution gets to add a new block to the blockchain and receives a reward—currently 3.125 bitcoins plus transaction fees.

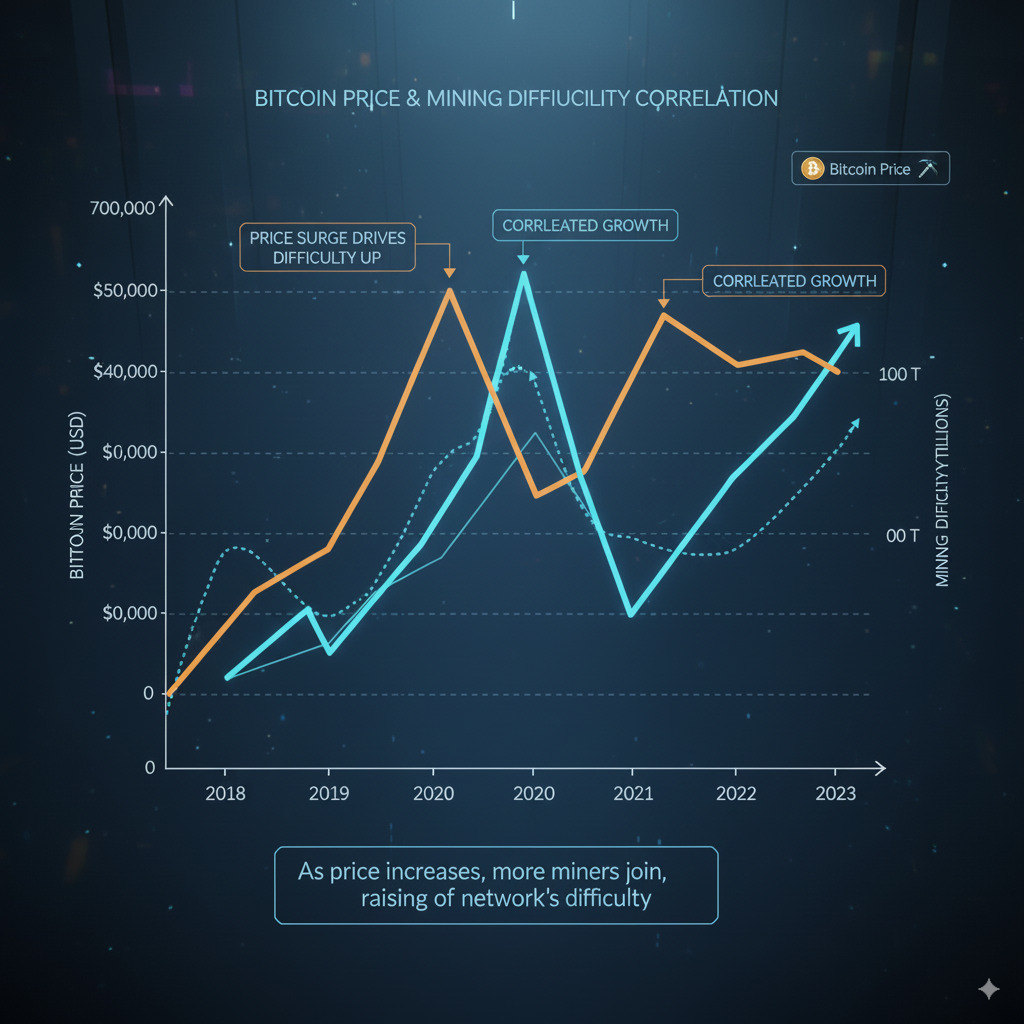

This process serves two critical functions: it secures the network by making attacks prohibitively expensive, and it introduces new bitcoins into circulation according to a predetermined schedule. The difficulty of these puzzles adjusts automatically to ensure new blocks are created approximately every 10 minutes, regardless of how much computing power joins the network.

Mining is the process by which new Bitcoin is introduced into circulation, and transactions are verified and added to the blockchain ledger.

The Three Tiers of Bitcoin Mining

While the goal is the same, the method, cost, and potential rewards for mining Bitcoin have created distinct ecosystems for corporations, groups, and individuals.

Industrial Scale

Massive operations run by publicly-traded companies with thousands of ASICs and custom infrastructure.

Pooled Mining

Groups of miners combining their computational resources to increase chances of earning rewards.

Home Mining

Individual enthusiasts running one or several ASIC miners from their homes or small facilities.

The Giants: Industrial-Scale Mining

Industrial mining operations represent the backbone of the Bitcoin network, contributing the majority of the global hashrate. These operations are characterized by massive scale, specialized infrastructure, and significant capital investment.

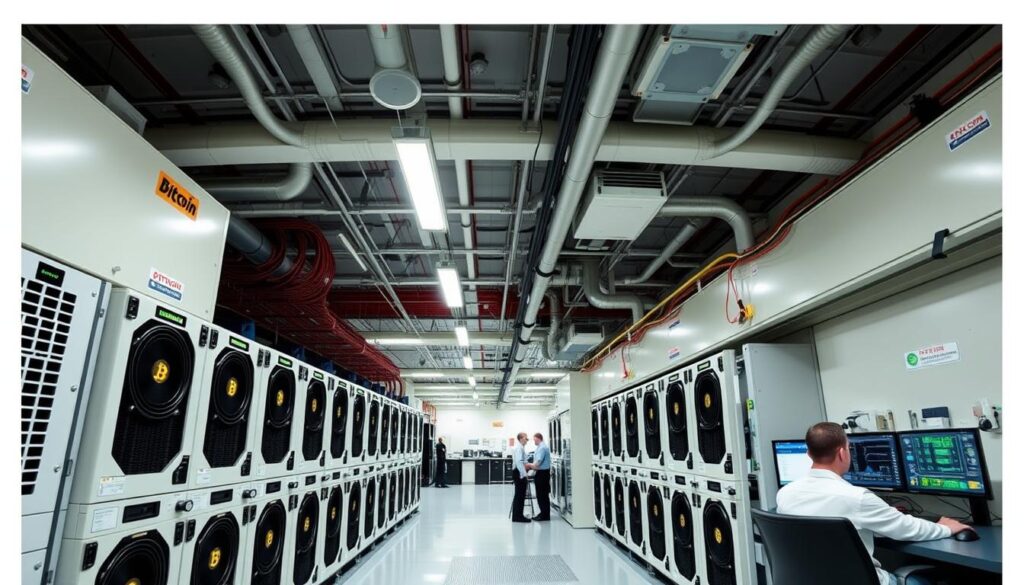

What It Looks Like

Picture a warehouse filled with tens of thousands of ASIC miners, arranged in rows with sophisticated cooling systems. These facilities often have direct relationships with power companies and may even be located next to power plants to minimize energy costs. The noise is deafening—imagine thousands of high-powered vacuum cleaners running simultaneously—and the heat generated requires industrial-grade cooling solutions.

Case Study: Marathon Digital Holdings

Marathon Digital is one of North America’s largest publicly traded Bitcoin mining companies. Their strategy focuses on economies of scale, deploying tens of thousands of the latest-generation ASIC miners across multiple facilities. As of 2025, they operate at over 23 exahash per second (EH/s)—that’s 23 quintillion calculations every second.

Advantages of Industrial Mining

- Access to wholesale electricity rates

- Bulk hardware discounts

- Professional maintenance and optimization

- Ability to relocate to regions with favorable regulations

- Economies of scale reducing per-bitcoin mining cost

Challenges of Industrial Mining

- Massive capital requirements ($100M+)

- Regulatory uncertainty in many jurisdictions

- Public scrutiny over energy consumption

- Exposure to Bitcoin price volatility

- Increasing global competition

The bottom line: Industrial mining is a capital-intensive race for efficiency where success is measured by hashrate dominance and the lowest possible cost per coin.

Strength in Numbers: Pooled Mining & Stratum V2

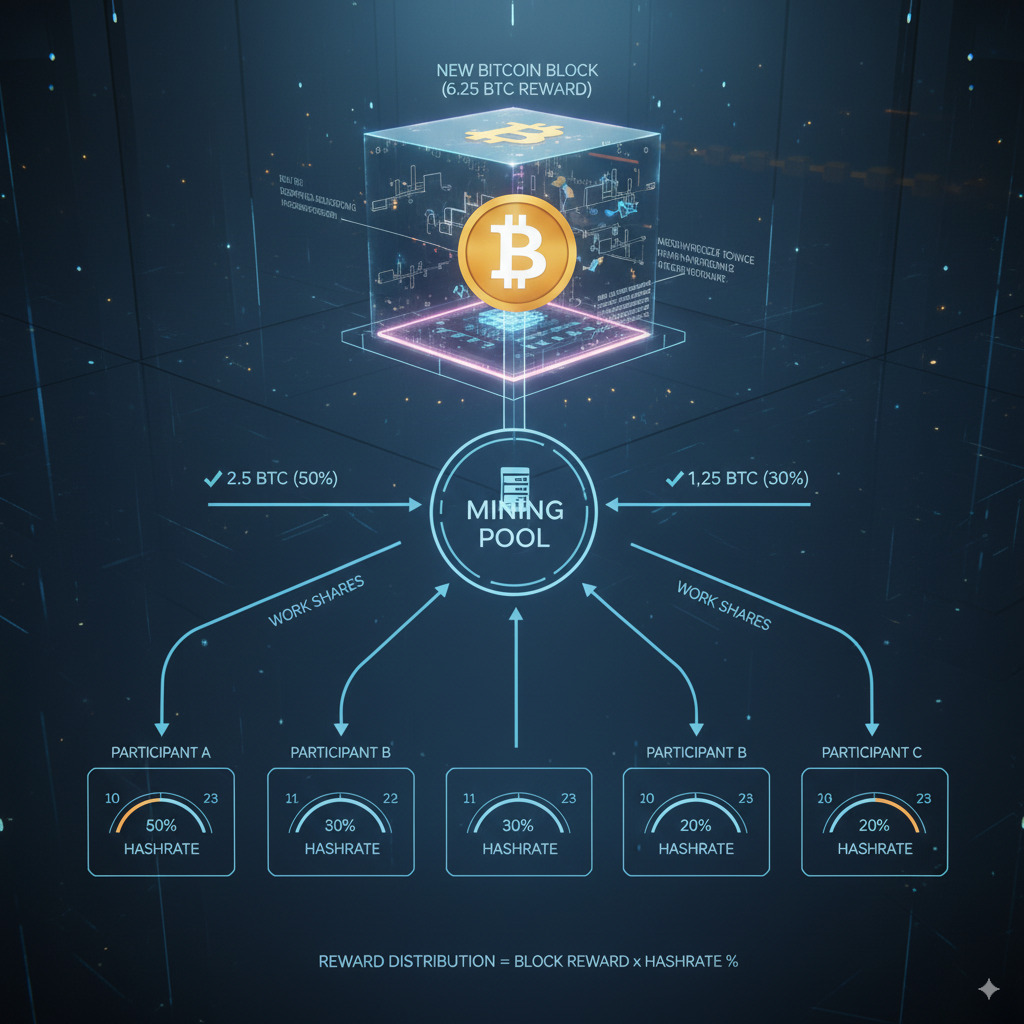

Mining pools emerged as a solution to the increasing difficulty of solo mining. By combining computational resources, miners increase their chances of earning rewards, much like joining an office lottery pool instead of playing alone.

Why Pools Exist

With Bitcoin’s current network difficulty, a single ASIC miner might take years to find a block independently. Mining pools solve this problem by allowing miners to combine their hashrate and share rewards proportionally to their contribution. This provides more consistent, albeit smaller, payouts.

Stratum V2: A Major Upgrade

Stratum V2 represents the next generation of mining pool protocols, addressing several limitations of the original Stratum protocol. This upgrade brings significant improvements to the pooled mining ecosystem:

| Feature | Stratum V1 | Stratum V2 |

| Transaction Selection | Pool operator controls | Individual miners can choose |

| Data Efficiency | High overhead | 60% reduction in data transfer |

| Security | Unencrypted | Encrypted connections |

| Hashrate Hijacking | Vulnerable | Protected |

| Decentralization | Limited | Enhanced |

Did you know? As of 2025, the two largest mining pools, Foundry USA and Antpool, collectively control nearly 60% of the Bitcoin network’s total hashrate.

The Hobbyist: Can You Still Mine Bitcoin at Home?

Home mining represents the grassroots level of Bitcoin’s decentralized network. While not as dominant as it once was, home mining remains viable under specific circumstances and continues to attract enthusiasts who value network participation and non-KYC bitcoin acquisition.

The Modern Home Mining Setup

Forget about using your laptop or gaming PC—those days are long gone for Bitcoin. Today’s home miners use dedicated ASIC (Application-Specific Integrated Circuit) machines designed specifically for mining. These devices consume significant electricity and generate substantial heat and noise.

Top ASIC Miners in 2025

| Model | Hashrate | Power Consumption | Efficiency | Approximate Cost |

| Bitmain Antminer S21 Pro | 234 TH/s | 3,510W | 15 J/TH | $8,000-$10,000 |

| MicroBT Whatsminer M66S | 298 TH/s | 5,513W | 18 J/TH | $11,000-$13,000 |

| Canaan Avalon A1566 | 150 TH/s | 3,225W | 21.5 J/TH | $5,000-$7,000 |

The Profitability Equation

Home mining profitability depends on several key factors:

Electricity Cost

The most critical factor. Competitive mining typically requires electricity costs below $0.06/kWh.

Hardware Investment

Modern ASICs cost $5,000-$13,000 and become less competitive over time as newer models emerge.

External Factors

Bitcoin price, network difficulty, and halving events significantly impact profitability.

Reality Check: For most home miners, Bitcoin mining is not a get-rich-quick scheme. It’s for enthusiasts who want to support the network, acquire non-KYC bitcoin, or have access to extremely cheap electricity.

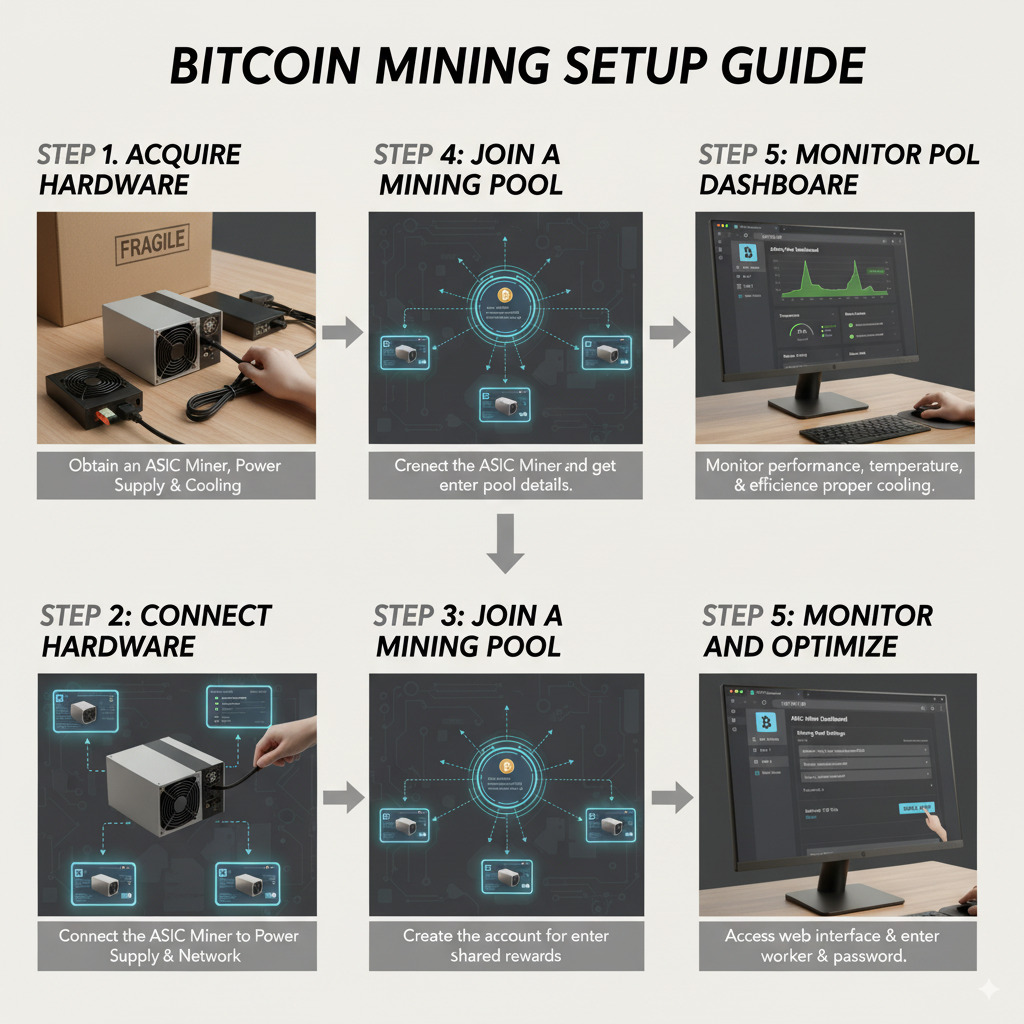

Getting Started with Bitcoin Mining

If you’re considering entering the world of Bitcoin mining, here’s a simplified roadmap to get started:

- Research and Education – Understand the fundamentals of Bitcoin, blockchain technology, and mining economics.

- Profitability Analysis – Calculate potential returns based on your electricity costs, hardware options, and current market conditions.

- Hardware Selection – Choose an ASIC miner that balances hashrate, efficiency, and your budget.

- Setup Preparation – Ensure you have adequate power capacity, cooling solutions, and noise management.

- Wallet Creation – Set up a secure Bitcoin wallet to receive mining rewards.

- Mining Software – Install appropriate mining software like CGMiner, BFGMiner, or EasyMiner.

- Pool Selection – Choose a mining pool that aligns with your values and offers favorable terms.

- Ongoing Maintenance – Monitor performance, manage cooling, and stay updated on network changes.

Important: Before investing in mining equipment, verify that Bitcoin mining is legal in your jurisdiction. Several countries have restricted or banned cryptocurrency mining due to energy concerns.

Future Trends in Bitcoin Mining

The Bitcoin mining landscape continues to evolve rapidly. Here are some key trends shaping the future of mining:

Sustainable Energy

Increasing shift toward renewable energy sources like hydro, solar, and stranded natural gas to address environmental concerns.

Hardware Efficiency

Continued advancement in ASIC technology, with 3-nanometer chips reducing power consumption and improving hashrate.

Regulatory Evolution

Growing regulatory frameworks specifically addressing mining operations, with both restrictions and incentives emerging globally.

While saying “I mine Bitcoin” certainly has a nice ring to it and may turn heads at a bar, it’s a highly competitive industry. The market exhibits characteristics of oligopolistic competition, where economies of scale play a crucial role in profitability.

Despite these challenges, there remains space for participants at all levels. Industrial operations will continue to dominate hashrate, but innovations like Stratum V2 are helping to preserve the decentralized ethos of Bitcoin by empowering smaller miners. For home miners, the focus may shift from pure profitability to supporting network resilience and acquiring bitcoin outside traditional exchanges.

Conclusion: A Diverse and Evolving Ecosystem

Bitcoin mining remains a core pillar of the network’s security and decentralization, with a place for participants of all sizes. Whether you’re running a warehouse full of ASICs, contributing to a mining pool, or operating a single miner in your garage, you’re participating in the most powerful decentralized computing network ever created.

The mining landscape will continue to evolve with technological advancements, regulatory developments, and market dynamics. What remains constant is the fundamental role miners play in securing transactions and maintaining the integrity of the Bitcoin network.

Is Bitcoin Mining Right for You?

Use this comprehensive calculator to analyze potential returns based on your specific circumstances.

What’s your experience with Bitcoin mining?

Have you tried mining Bitcoin or other cryptocurrencies? Are you considering setting up a mining operation? Share your thoughts and experiences in the comments below!