Transitioning from a simple exchange balance to self-custody reveals the true nature of Bitcoin holdings: a collection of Unspent Transaction Outputs (UTXOs). While many Bitcoin holders focus solely on their total balance, understanding and managing these discrete “digital bills” can dramatically impact your transaction costs, privacy, and long-term asset usability. As on-chain fees continue to rise and Bitcoin’s value increases, proactive UTXO management is becoming not just advantageous but essential for sovereign Bitcoin holders.

In this comprehensive guide, we’ll explore the fundamentals of the UTXO model, explain why proper management matters, and provide practical strategies to optimize your Bitcoin holdings for both current use and future-proofing.

Understanding the UTXO Model: Bitcoin’s Digital Cash System

Unspent Transaction Outputs (UTXOs) represent specific amounts of Bitcoin that you have received but not yet spent. Unlike traditional bank accounts that track a single balance figure, Bitcoin operates on a model where your wallet’s balance is actually the sum of these discrete “chunks” of Bitcoin.

The Digital Cash Analogy

Think of UTXOs as the digital equivalent of physical cash in your wallet. Just as you might have several bills of different denominations (a $20, two $10s, and five $1s), your Bitcoin wallet might contain several UTXOs of varying amounts (0.1 BTC, 0.05 BTC, 0.01 BTC, etc.). When you spend cash, you can’t tear a $20 bill in half to pay for a $10 item – you must use the whole bill and receive change. Similarly, when you spend Bitcoin, you must use entire UTXOs and receive change as a new UTXO.

UTXO vs. Account-Based Models

| Feature | UTXO Model (Bitcoin) | Account Model (Ethereum, Banks) |

| Balance Representation | Sum of discrete unspent outputs | Single balance figure per account |

| Transaction Mechanism | Consume UTXOs as inputs, create new UTXOs as outputs | Debit one account, credit another |

| Privacy Potential | Higher (with proper management) | Lower (all transactions tied to same account) |

| Parallelization | Better (unrelated UTXOs can be processed simultaneously) | Limited (account updates must be sequential) |

| Complexity | Higher (requires UTXO management) | Lower (simpler to understand) |

The UTXO model makes Bitcoin more auditable, transparent, and efficient than traditional financial systems, which rely on accounts, balances, and third parties. However, it also requires more active management to optimize for costs and privacy.

Why Proactive UTXO Management is Non-Negotiable

The Economics of Blockspace: Fee Calculation

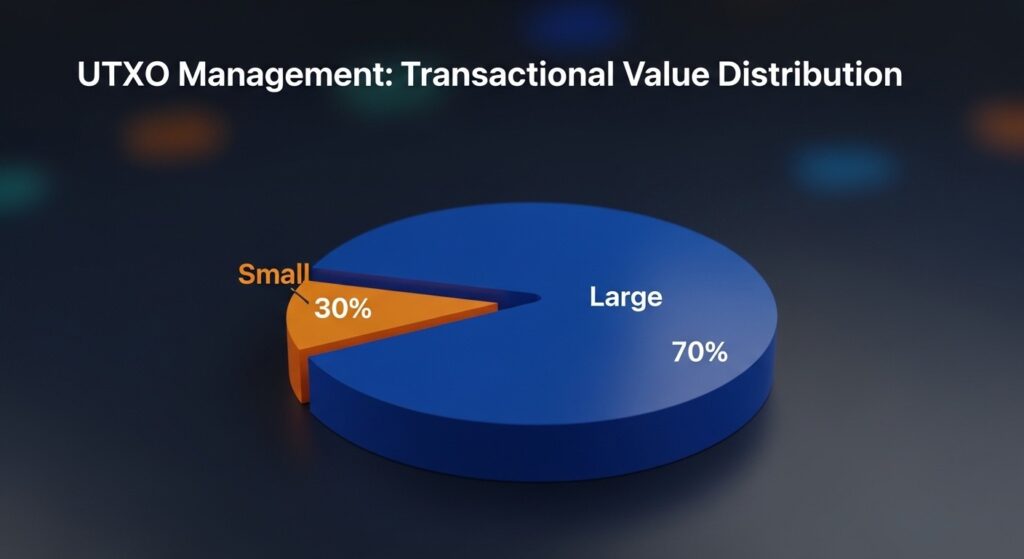

A critical misconception about Bitcoin transactions is that fees are based on the amount being sent. In reality, transaction fees are determined by the data size (measured in virtual bytes or vBytes) of your transaction – and the number of UTXOs you’re spending is a primary driver of this size.

When network congestion increases and blockspace becomes scarce, miners prioritize transactions that pay higher fees per vByte. If your wallet contains many small UTXOs, you’ll need to include more inputs in your transaction, increasing its size and therefore its cost. During fee spikes, this can make transactions prohibitively expensive.

Key Insight: A transaction moving 1 BTC using a single UTXO will cost significantly less than a transaction moving 0.1 BTC using ten smaller UTXOs, assuming the same fee rate.

The Privacy Implications of Poor UTXO Management

Every Bitcoin transaction is permanently recorded on the blockchain, creating a transparent history that can be analyzed. Without proper UTXO management, you risk revealing more information about your finances than you might intend.

The “common-input-ownership heuristic” is a blockchain analysis technique that assumes all inputs in a transaction belong to the same person. When you combine UTXOs from different sources in one transaction, you permanently link them together, potentially compromising your privacy.

The Growing Problem of Bitcoin Dust

What is Bitcoin Dust?

Bitcoin dust refers to UTXOs that are so small in value that spending them would cost more in transaction fees than the value of the bitcoin itself. As network fees rise, the threshold for what constitutes “dust” also increases.

While the technical protocol dust limit is around 546 satoshis, the practical or “operative” dust limit is determined by current fee rates. At high fee rates, even UTXOs worth hundreds of thousands of satoshis can effectively become dust.

“Even if an exchange offers free withdrawals to self-custody, without UTXO management, you still can end up paying high fees in the future when you spend those coins that are in self-custody.”

Why Small UTXOs Are Dangerous

As Bitcoin’s price rises, the fiat value of recommended minimum UTXO sizes increases. In 2019, when Bitcoin was around $5,000, a 0.01 BTC UTXO (a common recommended minimum) cost about $50. At $100,000 per Bitcoin, that same minimum UTXO costs $1,000 – pricing many regular DCA buyers out of proper UTXO management.

The danger comes when people continue buying small amounts of Bitcoin and immediately moving them to self-custody, creating numerous small UTXOs that may become economically unspendable in the future.

Core UTXO Management Strategies

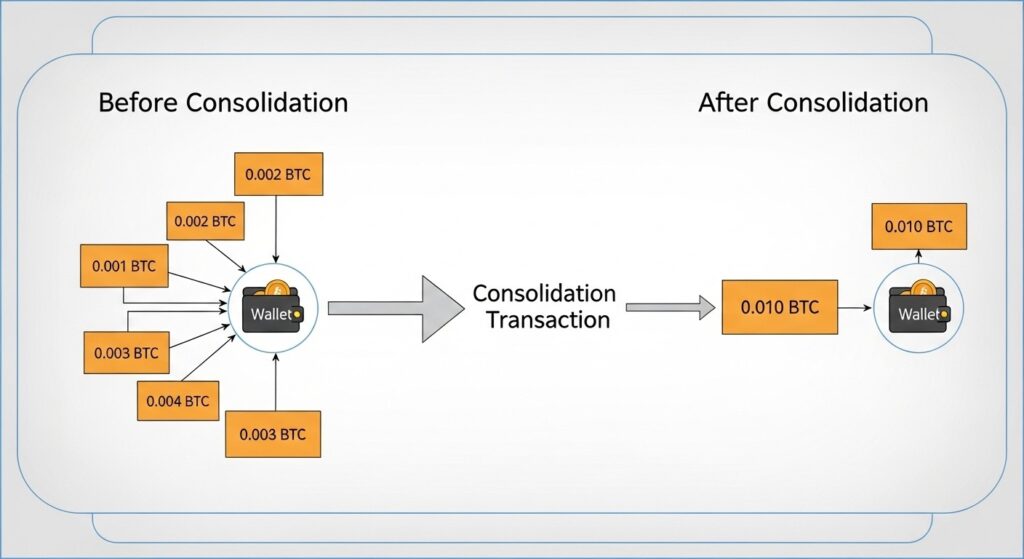

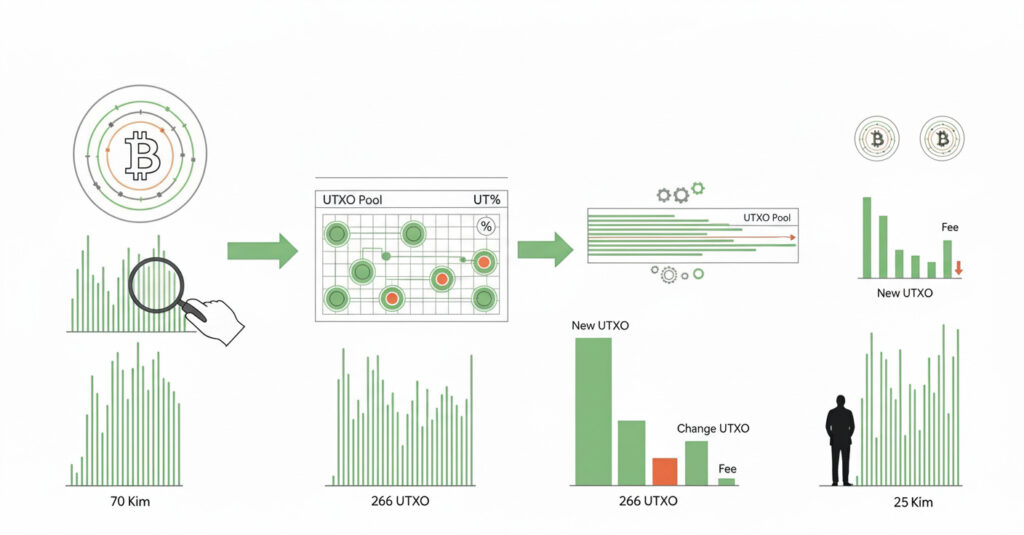

UTXO Consolidation: Combining Your Bitcoin

UTXO consolidation involves sending multiple small UTXOs to yourself to create a single, larger UTXO. This is similar to exchanging a handful of small bills for one larger bill at the bank. While this process incurs a transaction fee, it can save you significantly more in future transaction costs.

Best Practice: Consolidate UTXOs when network fees are low. Check current fee rates at mempool.space before consolidating.

The privacy trade-off is important to consider: consolidation links your UTXOs together on the blockchain. This is a deliberate privacy compromise that should be weighed against the fee savings.

Recommended Minimum UTXO Sizes

| Wallet Type | Recommended Minimum | Rationale |

| Segwit Singlesig | 0.01 BTC | P2WPKH (bc1q…): this format is the most efficient, requiring fewer bytes for a transaction. A 0.01 BTC UTXO is large enough that even with high fees (e.g., 200 sat/byte), the fee is a small fraction of the UTXO’s value. |

| Segwit 2-of-3 Multisig | 0.015 BTC | P2WSH (bc1q…): multisig transactions are larger because they require more signatures, which increases the transaction’s byte size. A 2-of-3 multisig transaction is larger than a single-sig one, so a larger UTXO is recommended to keep fees as a small percentage. |

| Segwit 3-of-5 Multisig | 0.02 BTC | P2WSH (bc1q…): as the number of signatures required for a transaction increases, so does its byte size. A 3-of-5 transaction is significantly larger than a 2-of-3, justifying a higher minimum UTXO size. |

| Taproot Singlesig | 0.005 BTC | P2TR (bc1p…): this recommendation is based on the technical reality that a simple Taproot transaction is smaller than a comparable SegWit transaction. A lower minimum UTXO size is thus practical while still protecting against high fees. |

Mastering Coin Selection: Advanced UTXO Control

Understanding Coin Selection Algorithms

Coin selection refers to how your wallet chooses which UTXOs to use when creating a transaction. Different algorithms balance competing goals of minimizing fees, preserving privacy, and avoiding dust creation.

| Algorithm | Description | Pros | Cons |

| First-In-First-Out (FIFO) | Selects oldest UTXOs first | Simple, predictable | Not optimized for fees or privacy |

| Branch and Bound | Finds optimal combination of UTXOs to minimize change | Efficient fee usage, reduces UTXO creation | Complex, may combine unrelated UTXOs |

| Coin Control (Manual) | User manually selects UTXOs | Maximum control over privacy and fees | Requires knowledge and effort |

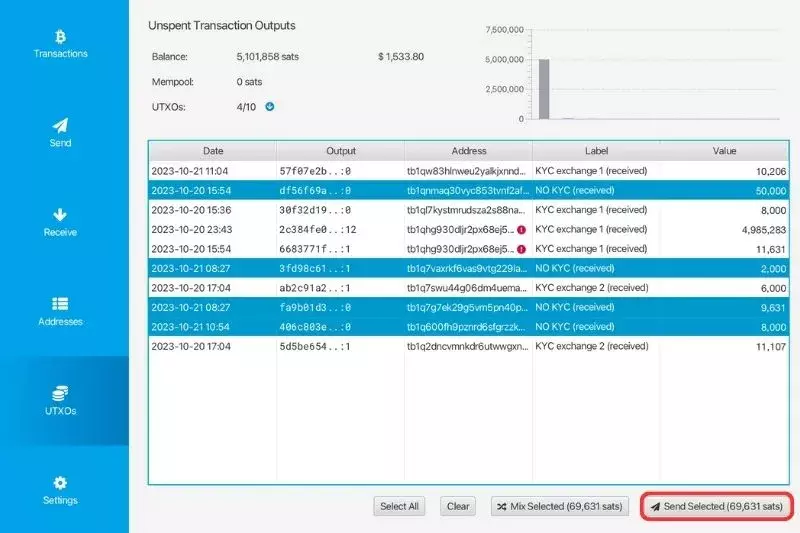

Using Coin Control Features

Advanced Bitcoin wallets offer “Coin Control” features that allow you to manually select which UTXOs to spend in a transaction. This gives you granular control over fees, privacy, and change management.

Wallets with robust coin control features include:

- Sparrow Wallet (desktop)

- Wasabi Wallet (desktop)

- Electrum (desktop)

- BlueWallet (mobile, limited features)

Need Help With UTXO Management?

Our Bitcoin experts can help you optimize your UTXO structure, reduce future transaction costs, and enhance your financial privacy.

Advanced Privacy Techniques in UTXO Management

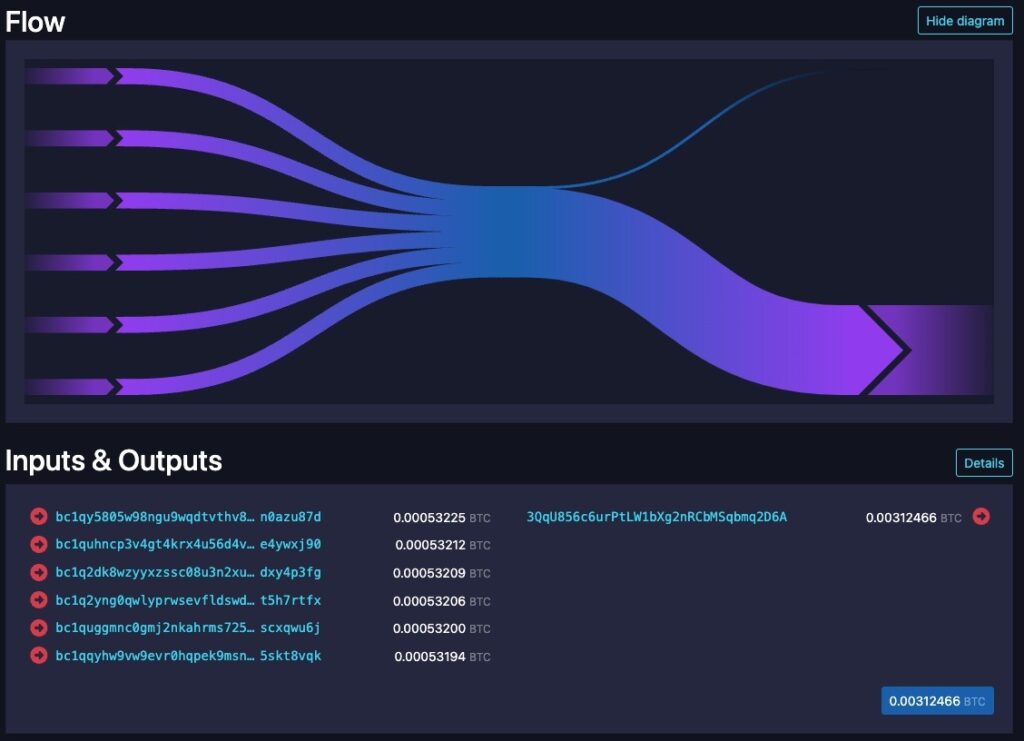

Breaking Heuristics with CoinJoin

CoinJoin is a privacy technique where multiple users combine their payments into a single, large transaction. This makes it difficult for blockchain analysts to link specific inputs to specific outputs, breaking the common-input-ownership heuristic.

In a CoinJoin transaction, several users contribute equal-sized inputs and receive equal-sized outputs, creating ambiguity about which output belongs to which user. This provides plausible deniability and enhances privacy for all participants.

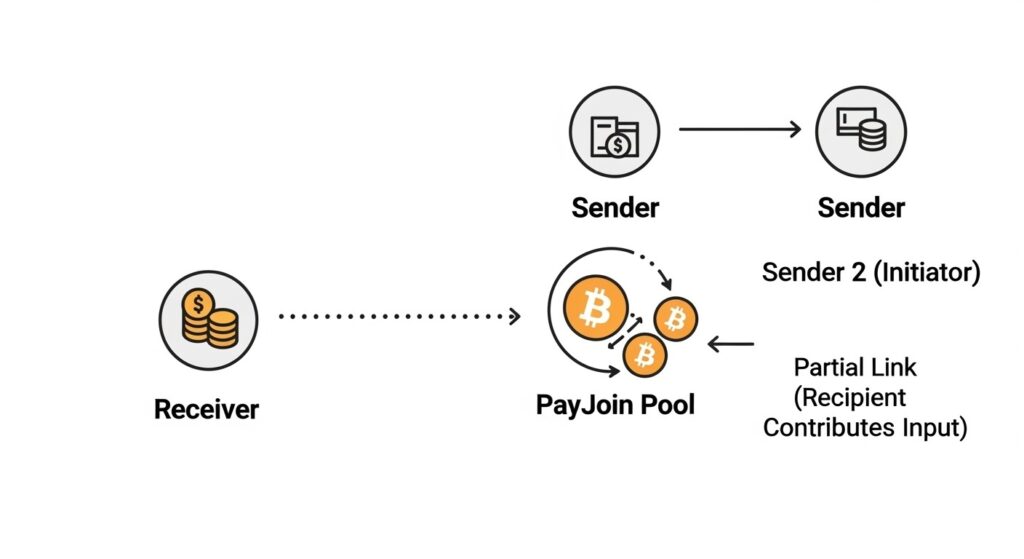

Undetectable Privacy with PayJoin

PayJoin (also known as Pay-to-EndPoint or P2EP) is an advanced privacy technique where both the sender and receiver contribute inputs to a payment transaction. This creates a transaction that looks completely normal to observers but breaks the assumption that all inputs belong to the sender.

The key advantage of PayJoin is that these transactions are indistinguishable from normal transactions, degrading the reliability of chain analysis heuristics for the entire network. However, PayJoin requires coordination between sender and receiver, limiting its current adoption.

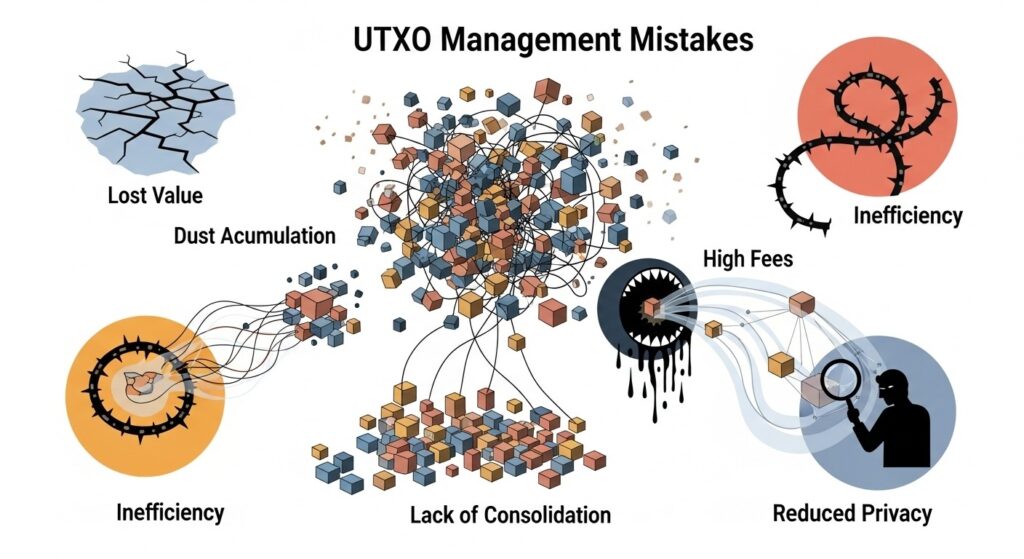

Common UTXO Management Pitfalls to Avoid

The DCA Dilemma: Accumulating Dust

Many Bitcoin users who dollar-cost average (DCA) make the mistake of frequently withdrawing small amounts from exchanges to self-custody. This creates numerous small UTXOs that can become expensive or impossible to spend during high-fee periods.

Solution: Batch your withdrawals. Accumulate purchases on the exchange and withdraw larger amounts less frequently to ensure your UTXOs remain above the recommended minimum sizes.

The Unspendable Future: Ignoring Fee Market Trends

Creating small change outputs that aren’t technically dust now but risk becoming “operative dust” in a future high-fee environment can lead to stranded funds. As Bitcoin’s price and adoption increase, on-chain fees are likely to rise substantially.

Be mindful of creating UTXOs below your personal threshold (based on wallet type) and consolidate them during periods of low network fees to ensure long-term spendability.

The Cardinal Sin of Privacy: Mixing KYC and Non-KYC UTXOs

One of the most serious privacy mistakes is combining UTXOs from KYC sources (regulated exchanges where your identity is known) with non-KYC UTXOs in a single transaction. This “tainting effect” permanently links your real-world identity to your entire stack of coins.

Maintain strict wallet segregation between KYC and non-KYC funds to preserve the privacy benefits of your non-KYC holdings.

Practical Steps to Implement Today

Immediate Actions for Better UTXO Management

-

Audit your current UTXOs: Use a wallet with coin control features to examine your current UTXO set. Identify small UTXOs that might benefit from consolidation.

-

Set withdrawal thresholds: Configure your exchange accounts to only withdraw when you’ve accumulated enough Bitcoin to create appropriately sized UTXOs (based on your wallet type).

-

Consolidate strategically: During periods of low network fees, consolidate small UTXOs into larger ones. Check mempool.space for current fee rates.

-

Implement wallet segregation: Use separate wallets for different purposes (spending, savings, KYC vs. non-KYC) to maintain privacy and optimize UTXO management for each use case.

Long-term Strategies

As Bitcoin’s value and adoption increase, consider these long-term strategies:

- Gradually increase your minimum UTXO size threshold as Bitcoin’s price rises

- Consider using Lightning Network for smaller, frequent transactions

- Explore collaborative custody solutions that offer UTXO management assistance

- Stay informed about Bitcoin protocol developments that may impact UTXO management

Tools and Resources for Effective UTXO Management

Recommended Wallets with Advanced UTXO Features

Sparrow Wallet

Desktop wallet with excellent coin control features, UTXO labeling, and detailed transaction analysis.

Electrum

Veteran desktop wallet with robust coin control and support for hardware wallets.

BlueWallet

Mobile wallet with basic coin control features for on-the-go UTXO management.

Useful Online Resources

- mempool.space – Monitor current fee rates to time consolidations

- Bitcoin Ops – Technical resources on Bitcoin transaction optimization

- UTXO.live – Visualize and analyze the global UTXO set

Conclusion: The Path to Bitcoin Sovereignty

Effective UTXO management is a multi-faceted discipline that balances transaction costs, privacy, and usability. As Bitcoin’s value and adoption continue to grow, these skills will become increasingly essential for all users who wish to maintain sovereignty over their digital assets.

By understanding the UTXO model, implementing proper management strategies, and avoiding common pitfalls, you transform from a passive holder to a sovereign, efficient, and private actor on the Bitcoin network. This knowledge not only helps you optimize your current Bitcoin usage but also ensures your holdings remain accessible and useful in the future, regardless of fee market conditions.

Remember that UTXO management is not a one-time task but an ongoing practice that evolves with the Bitcoin network and your own holdings. Start implementing these strategies today to secure your Bitcoin sovereignty for years to come.

Bitcoin UTXO Management Glossary

UTXO

Unspent Transaction Output; a discrete amount of bitcoin that has been received but not yet spent.

Dust

UTXOs so small that the transaction fee to spend them would equal or exceed their value.

Coin Selection

The process by which a wallet chooses which UTXOs to use as inputs for a transaction.

Consolidation

The process of combining multiple smaller UTXOs into a single larger UTXO.

CoinJoin

A privacy technique where multiple users combine their transactions to break the common-input-ownership heuristic.

PayJoin

A privacy-enhancing transaction where both sender and receiver contribute inputs.

vByte

Virtual Byte; the unit used to measure Bitcoin transaction size for fee calculation.

Coin Control

A wallet feature allowing manual selection of which UTXOs to spend in a transaction.