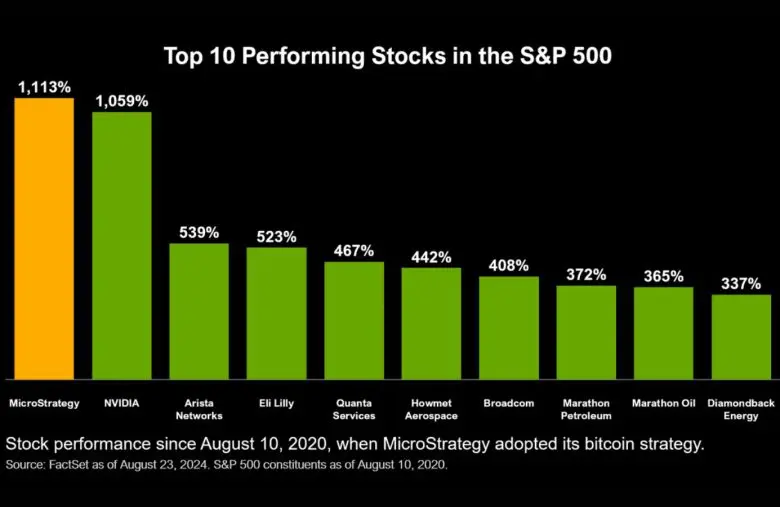

In August 2020, MicroStrategy made a decision that would transform both the company and the corporate finance landscape: it converted $250 million of cash reserves into Bitcoin. This move, spearheaded by CEO Michael Saylor, marked the beginning of MicroStrategy’s evolution from a business intelligence software provider into what it now calls a “Bitcoin Treasury Company.” Today, the firm holds over 628,000 Bitcoin worth approximately $75 billion, making it the largest corporate Bitcoin holder by a significant margin.

This comprehensive guide explores MicroStrategy’s revolutionary Bitcoin treasury strategy, examining how it uses various financial instruments—MSTR common stock and its suite of preferred shares (STRK, STRF, STRD, STRC)—to fund its aggressive Bitcoin accumulation. Whether you’re an investor seeking Bitcoin exposure through public markets or a corporate finance professional curious about alternative treasury strategies, this analysis provides valuable insights into one of the most innovative financial experiments of our time.

The Genesis of a Bitcoin Treasury Company

MicroStrategy’s pivot to Bitcoin began with a fundamental problem: how to preserve shareholder value in an era of unprecedented monetary expansion. In 2020, as central banks worldwide engaged in massive quantitative easing, Michael Saylor identified what he called a “melting ice cube” problem—cash reserves were losing purchasing power at an accelerating rate.

The solution was radical yet simple: convert the company’s cash reserves into Bitcoin, which Saylor viewed as “digital gold” with superior properties to physical gold. By February 2025, the company officially rebranded from MicroStrategy to “Strategy,” cementing its identity as the world’s first and largest Bitcoin Treasury Company.

The core thesis driving this transformation rests on three pillars:

This strategy represents a fundamental rethinking of corporate treasury management. Rather than holding cash as a defensive asset, Strategy views Bitcoin acquisition as an offensive move—one that positions the company to capture value from what it believes is the emergence of a new global monetary standard.

Uncertain about Bitcoin’s role in your investment strategy?

Our AI-powered advisory service can help you understand how Bitcoin fits into your financial future and develop a personalized strategy aligned with your goals.

Deconstructing the MSTR Stock: The Core of the Strategy

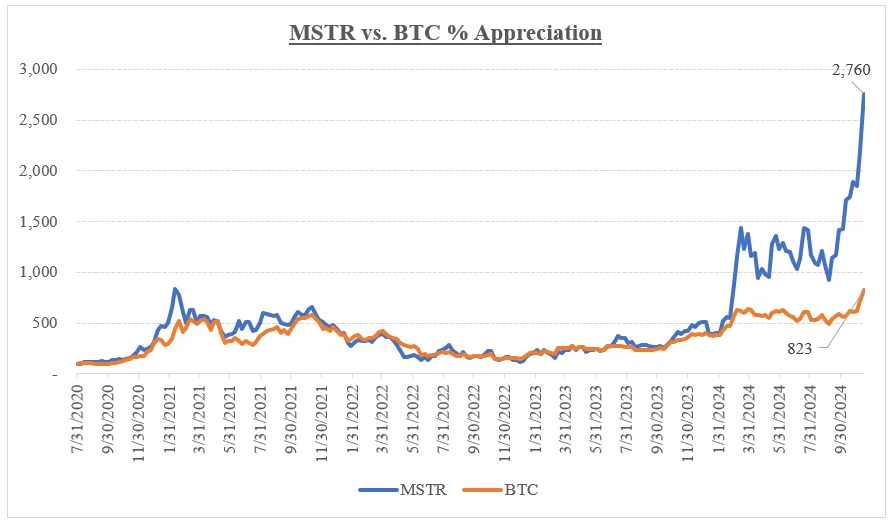

MSTR common stock represents the purest and most leveraged way to gain exposure to Strategy’s Bitcoin treasury. Unlike Bitcoin ETFs or mining stocks, MSTR offers a unique value proposition: it trades at what the company calls a “modified Net Asset Value” (mNAV) premium to its Bitcoin holdings.

This premium exists for several reasons. First, Strategy has demonstrated an ability to raise capital at favorable terms, allowing it to acquire more Bitcoin than its market capitalization would suggest. Second, the company’s operational business continues to generate cash flow, adding a baseline of value. Third, the market prices in Strategy’s future capital raising potential and Bitcoin acquisition expertise.

“MSTR stock is not just a Bitcoin proxy—it’s a Bitcoin compounding machine designed to increase Bitcoin per share over time.”

The key performance indicator that Strategy emphasizes is “Bitcoin per share” (BPS), which measures how much Bitcoin exposure each shareholder effectively owns. The company’s goal is to increase this metric over time through strategic capital raises and Bitcoin acquisitions, even if it means temporary dilution of existing shareholders.

This approach creates a high-risk, high-reward investment profile. When Bitcoin’s price rises, MSTR stock typically outperforms Bitcoin due to its leveraged nature. However, during Bitcoin price declines, MSTR can experience more significant drawdowns for the same reason.

A Primer on MicroStrategy’s Preferred Stocks

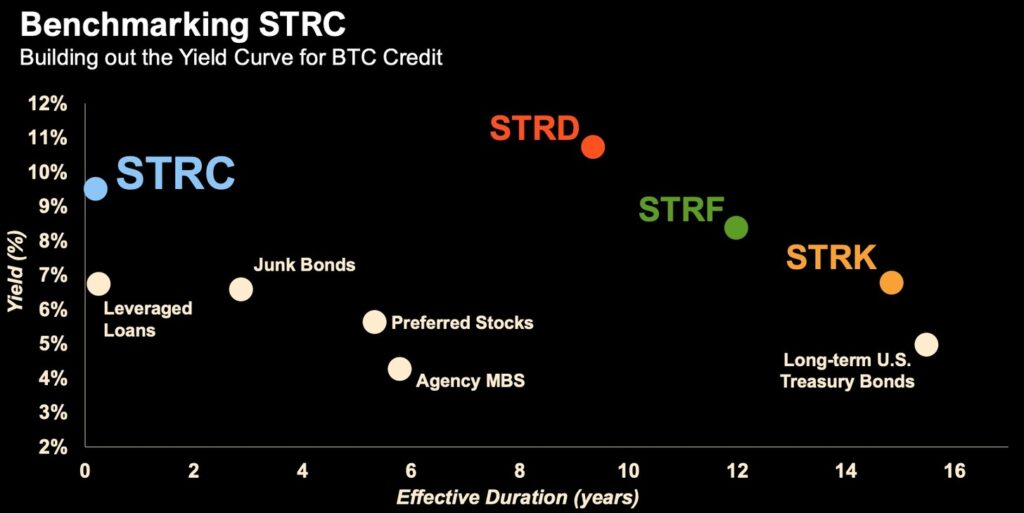

To diversify its capital raising capabilities and attract different investor profiles, Strategy has created a suite of preferred stock offerings. Each instrument is designed with specific risk-return characteristics, creating what the company calls a “capital formation matrix” that can appeal to various investor preferences.

These preferred stocks represent a financial innovation in the Bitcoin space—they allow Strategy to raise capital for Bitcoin acquisition while providing investors with yield-generating instruments backed by the company’s growing Bitcoin treasury. Let’s examine each instrument in detail:

STRF: The Conservative Play

STRF offers a fixed, cumulative 10.00% dividend, making it the most conservative option in Strategy’s preferred stock lineup. This instrument is designed for income-focused investors who want exposure to the company’s Bitcoin strategy with reduced volatility.

Key features include:

STRK: The Hybrid Play

STRK combines an 8.00% fixed, cumulative dividend with a convertibility feature, offering a balanced approach between income and growth potential. This hybrid instrument appeals to investors seeking current income with upside exposure to MSTR’s performance.

Key features include:

STRD: The High-Yield Play

STRD offers a 10.00% fixed dividend that is non-cumulative, creating a higher-risk, higher-yield profile. This instrument targets yield-hungry investors willing to accept additional risk for premium income in the current interest rate environment.

Key features include:

STRC: The Price Stability Play

STRC represents Strategy’s most innovative preferred offering, featuring a variable rate monthly dividend designed to maintain the stock’s price near its par value. Michael Saylor has described this as the company’s “iPhone moment” in financial engineering.

The STRC instrument works by adjusting its dividend rate monthly to target a stable share price, effectively transferring price volatility to income volatility. This creates several unique characteristics:

STRC represents a significant innovation in the Bitcoin financial ecosystem, potentially creating a new asset class that combines Bitcoin exposure with price stability and regular income—characteristics previously unavailable in the cryptocurrency space.

Strategic Comparison: MSTR vs. The Preferreds

When evaluating Strategy’s various investment vehicles, it’s essential to understand how they differ in terms of risk, return potential, and investor suitability. The company has deliberately created a spectrum of options to appeal to different investor profiles and objectives.

| Instrument | Risk Level | Income Focus | Growth Potential | Bitcoin Exposure | Ideal Investor Profile |

| MSTR Common | Highest | None | Highest | Direct & Leveraged | Growth-focused Bitcoin bull with high risk tolerance |

| STRK Preferred | Medium-High | Medium | Medium | Hybrid | Balanced investor seeking income with upside potential |

| STRF Preferred | Medium | High | Low | Indirect | Income-focused investor with moderate risk tolerance |

| STRD Preferred | Medium-High | Highest | Low | Indirect | Yield-seeking investor comfortable with dividend risk |

| STRC Preferred | Medium | Variable | Low | Indirect with Stability | Stability-focused investor seeking regular income |

The key insight from this comparison is that Strategy has created a complete financial ecosystem around its Bitcoin treasury. Investors can select their preferred risk-return profile while still gaining exposure to the company’s Bitcoin strategy. This innovation extends beyond traditional corporate finance approaches and represents a new model for how companies can structure their capital formation around Bitcoin.

MSTR Common Stock Advantages

- Maximum upside potential during Bitcoin bull markets

- Leveraged exposure without expiration or funding costs

- Liquidity and options market availability

- Potential S&P 500 inclusion in the future

Preferred Stock Advantages

- Regular income through dividend payments

- Reduced volatility compared to common stock

- Priority in capital structure

- Tailored risk-return profiles for different needs

This strategic diversification of capital instruments allows Strategy to tap into different investor bases and optimize its capital raising capabilities. For investors, it provides multiple entry points into the company’s Bitcoin treasury strategy based on individual risk tolerance and investment objectives.

Capital Markets as a Bitcoin Refinery

One of the most innovative aspects of Strategy’s approach is its use of capital markets as what Michael Saylor calls a “Bitcoin refinery.” This concept refers to the company’s ability to convert market demand for its securities into Bitcoin holdings at scale, unconstrained by free cash flow limitations.

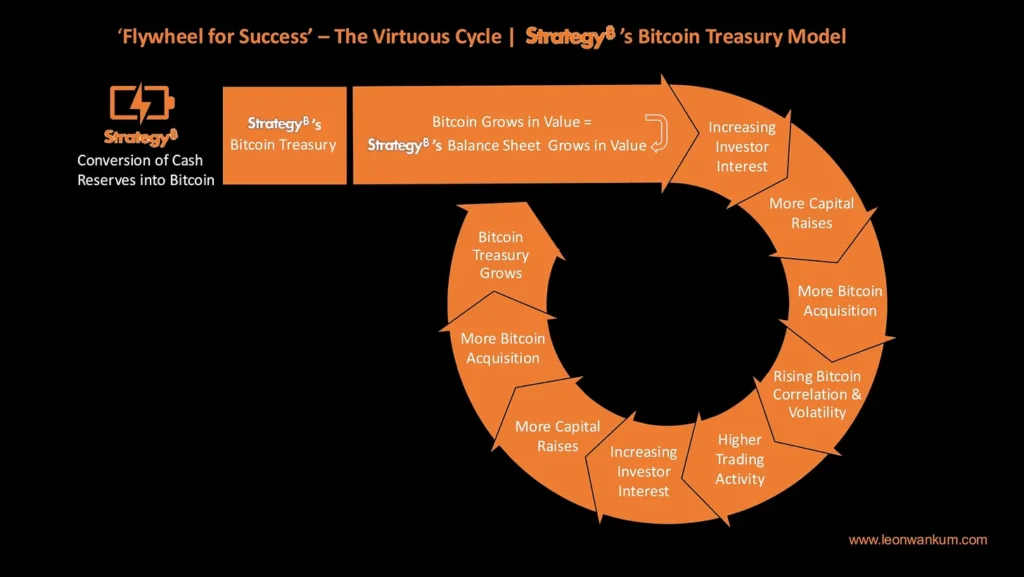

The process works through a virtuous cycle:

This approach demonstrates that corporate finance can evolve from static balance sheet preservation into active balance sheet engineering, leveraging market mechanisms to accumulate superior assets. Strategy has raised billions through this method, including $10 billion in just the first four months of 2025.

Key Insight: Strategy’s “42/42 Plan” aims to raise $42 billion in equity and $42 billion in fixed income by the end of 2027, demonstrating the scalability of this approach.

For corporate treasurers and CFOs, this model illustrates how companies can use financial engineering to transform their balance sheets. Rather than viewing treasury as a passive holder of assets, Strategy treats it as an active value creation engine focused on acquiring what it believes is the world’s scarcest and most desirable monetary asset.

Bitcoin-Centric Performance Metrics

Strategy has developed a unique set of performance metrics focused on Bitcoin accumulation rather than traditional financial measures. These Bitcoin-centric KPIs provide insight into how effectively the company is executing its treasury strategy.

Bitcoin Yield

Bitcoin Yield measures the growth in Bitcoin per share, net of any dilution from capital raises. Increased Bitcoin exposure over time, regardless of price fluctuations.

Strategy’s 2025 target: 25% Bitcoin Yield

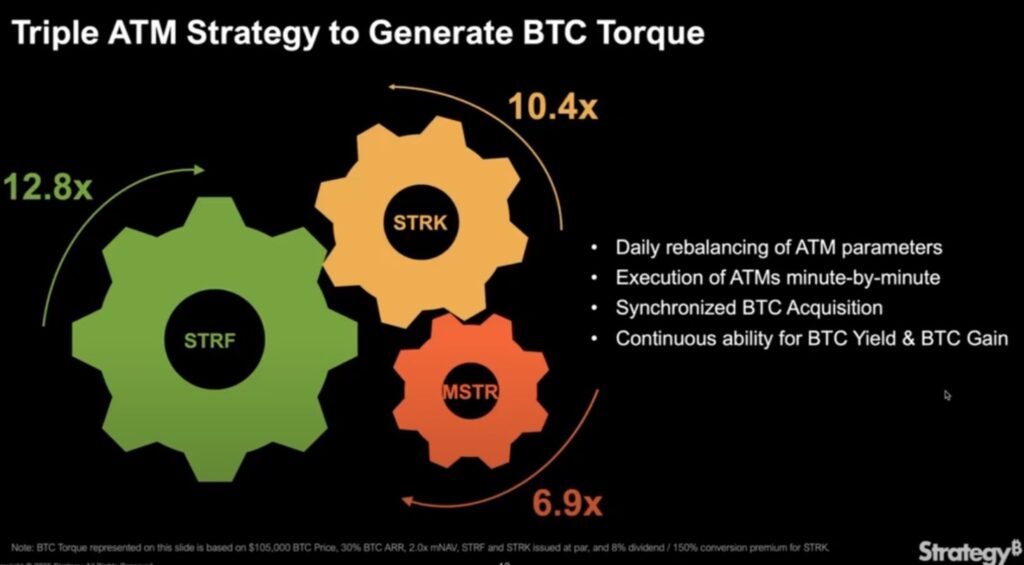

Bitcoin Torque

Bitcoin Torque measures the value created for shareholders per dollar of capital raised. It quantifies the efficiency of Strategy’s capital raising activities in terms of Bitcoin acquisition.

Higher torque indicates more efficient capital deployment

Modified NAV (mNAV)

Modified NAV represents the premium at which Strategy trades relative to its Bitcoin holdings. This metric helps investors understand the market’s valuation of Strategy’s Bitcoin treasury approach.

Strategy uses mNAV thresholds to guide its capital raising activities

These metrics represent a fundamental shift in how corporate performance can be measured in a Bitcoin standard world. Rather than focusing solely on earnings per share or revenue growth, Strategy emphasizes Bitcoin accumulation efficiency and shareholder value creation through increased Bitcoin exposure.

Did you know? Strategy’s Q2 2025 earnings showed an EPS beat of 46,671% compared to analyst expectations, largely due to Bitcoin appreciation on its balance sheet.

By establishing these Bitcoin-centric metrics, Strategy has created a new framework for evaluating corporate treasury performance in the digital asset era. This approach may become increasingly relevant as more companies consider Bitcoin allocation as part of their treasury strategy.

Conclusion: Redefining Corporate Treasury in the Bitcoin Era

Strategy’s Bitcoin treasury approach represents one of the most innovative financial experiments of our time. By transforming from a traditional software company into the world’s largest corporate Bitcoin holder, it has created a new model for how companies can approach treasury management in an era of monetary uncertainty.

The company’s suite of financial instruments—MSTR common stock and its preferred offerings (STRK, STRF, STRD, STRC)—provides a comprehensive toolkit for capital formation around Bitcoin. This financial engineering allows Strategy to accelerate its Bitcoin acquisition beyond what would be possible through operational cash flow alone.

For investors, these instruments offer multiple ways to gain exposure to Bitcoin through public markets, each with different risk-return profiles. For corporate finance professionals, Strategy’s approach demonstrates how companies can leverage their balance sheets and capital market access to accumulate what they believe is a superior store of value.

As we move forward, Strategy’s experiment will continue to provide valuable insights into the viability of Bitcoin as a corporate treasury asset. Whether this approach becomes a blueprint for other companies or remains unique to Strategy, it has undoubtedly expanded the possibilities for corporate finance in the digital age.

Strategy’s approach offers leveraged exposure to Bitcoin through financial engineering. By raising capital at a premium to its Bitcoin holdings and immediately converting it to Bitcoin, the company can acquire more Bitcoin than would be possible through direct purchase with the same initial capital. Additionally, Strategy’s instruments offer various risk-return profiles that aren’t available through direct Bitcoin ownership.

What happens to Strategy’s business model if Bitcoin experiences a prolonged bear market?

Strategy has structured its balance sheet to withstand significant Bitcoin price volatility. The company has no debt maturities until 2028, and its preferred stock instruments are designed with various protections. Additionally, Strategy continues to operate its profitable software business, which provides ongoing cash flow regardless of Bitcoin’s price performance.

How does Strategy’s approach compare to Bitcoin ETFs as an investment vehicle?

Bitcoin ETFs offer direct, unlevered exposure to Bitcoin with lower volatility than MSTR stock. However, they lack the potential upside from Strategy’s leveraged approach and financial engineering. ETFs typically charge annual management fees, while Strategy’s instruments have different cost structures. The choice between them depends on an investor’s risk tolerance, return expectations, and preference for direct versus indirect Bitcoin exposure.