When we secure our Bitcoin through self-custody, we solve one critical problem—protecting our assets from third-party risk. Yet this creates another challenge: what happens to those assets when we’re no longer here? Unlike traditional financial systems with established inheritance processes, Bitcoin’s decentralized nature means your digital wealth could be permanently lost without proper planning. This comprehensive guide will walk you through creating a robust Bitcoin inheritance plan that balances security, privacy, and accessibility—ensuring your digital legacy remains intact for your beneficiaries.

The Unique Challenges of Bitcoin Inheritance

Bitcoin inheritance presents fundamentally different challenges than traditional assets. When someone passes away, their bank accounts, real estate, and investment portfolios have established inheritance mechanisms with institutions that can verify identities and transfer ownership. Bitcoin operates differently.

The “Not Your Keys, Not Your Coins” Paradox

The core Bitcoin philosophy—that self-custody provides true ownership—creates a significant inheritance dilemma. Without access to private keys or seed phrases, your Bitcoin becomes permanently inaccessible. Unlike a bank that can verify your heir’s identity and grant access, there’s no central authority to help recover Bitcoin if keys are lost.

This creates a challenging balance: maintaining secure self-custody during life while ensuring authorized access after death.

The Privacy vs. Accessibility Dilemma

Bitcoin holders face a fundamental contradiction: the security practices that protect assets during life can prevent inheritance after death. Keeping seed phrases private and secure means they might remain undiscovered by heirs. Conversely, making inheritance information too accessible creates security vulnerabilities during your lifetime.

Finding the right balance between privacy and accessibility is essential for effective Bitcoin inheritance planning.

Critical Risk: Research suggests that approximately 1.5-4 million Bitcoin (worth billions of dollars) are likely already inaccessible due to lost keys or deaths without proper inheritance planning. Without a clear plan, your Bitcoin holdings could join these permanently lost assets.

Traditional Estate Planning Tools for Bitcoin

While Bitcoin requires specialized technical considerations, traditional estate planning tools still form the foundation of a comprehensive inheritance strategy. However, these tools must be adapted to address the unique characteristics of digital assets.

Wills and Bitcoin: Limitations and Considerations

A will is the most basic estate planning tool, but it has significant limitations for Bitcoin inheritance:

Advantages of Wills

- Legal recognition in most jurisdictions

- Simple to create and update

- Can designate specific beneficiaries for your Bitcoin

- Provides clear instructions to executors

Limitations of Wills

- Becomes public record during probate

- Never include private keys or seed phrases in a will

- Probate process can be lengthy, exposing assets to market volatility

- Executors may lack technical knowledge to access Bitcoin

Trusts: Enhanced Privacy and Control

Trusts offer significant advantages for Bitcoin inheritance planning, particularly for larger holdings:

Benefits of Using Trusts for Bitcoin Inheritance

- Privacy protection – Trust documents remain private, unlike wills

- Probate avoidance – Assets transfer directly without court involvement

- Flexibility – Can include detailed technical instructions and conditions

- Continuity – Allows for management during incapacity, not just after death

- Asset protection – May shield Bitcoin from creditors or legal claims

Choosing the Right Fiduciary

Whether using a will or trust, selecting the right executor or trustee is crucial for Bitcoin inheritance:

| Fiduciary Type | Advantages | Disadvantages | Best For |

| Family Member | Personal relationship, trusted, may work without fees | May lack technical knowledge, emotional burden | Smaller holdings with simple setup |

| Technical Friend | Bitcoin knowledge, technical expertise | Potential conflicts of interest, may move away | Medium holdings with some technical complexity |

| Professional Trustee | Legal expertise, institutional continuity | Higher fees, may lack Bitcoin knowledge | Larger holdings requiring long-term management |

| Specialized Crypto Trustee | Combined legal and technical expertise | Limited availability, higher costs | Complex holdings with multiple cryptocurrencies |

Important: Regardless of which traditional estate planning tool you use, never include private keys, seed phrases, or detailed wallet access information in the document itself. Instead, reference separate secure instructions that explain how to access your Bitcoin.

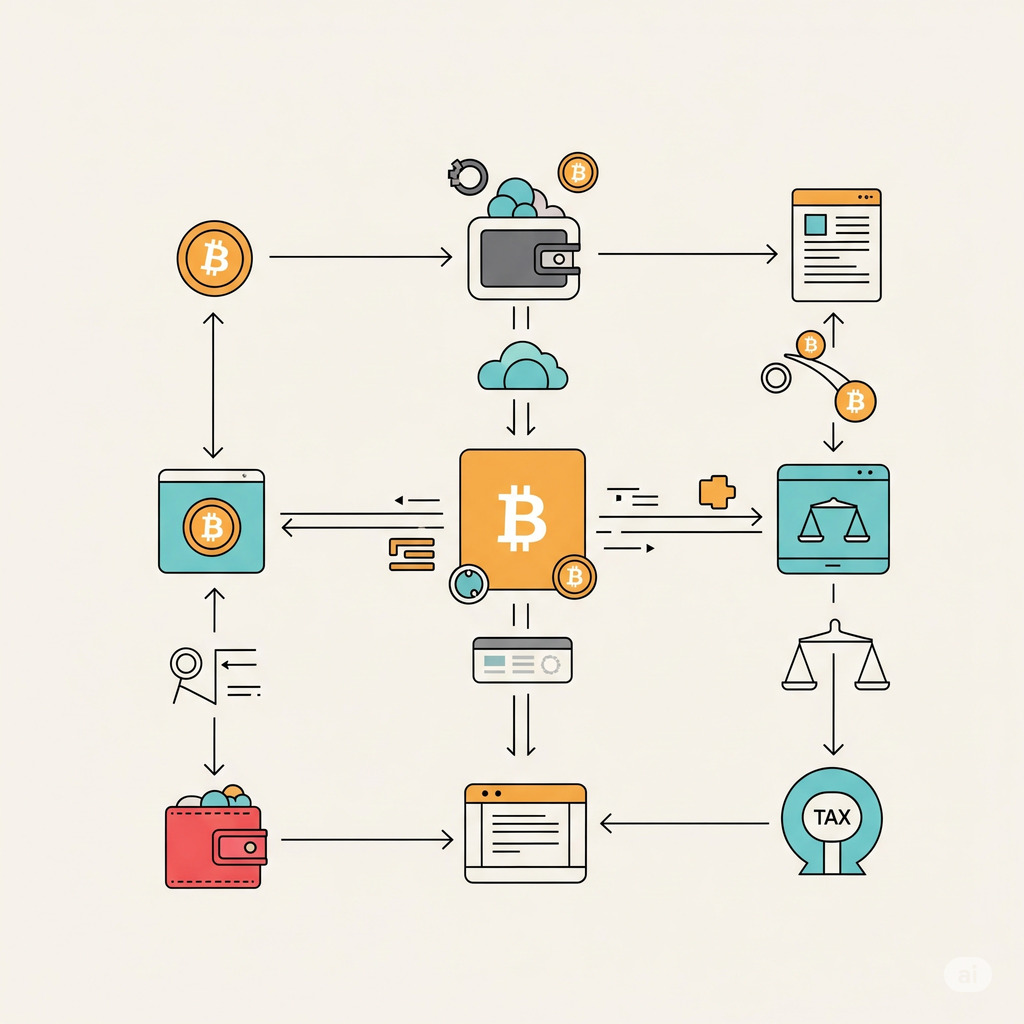

Technical Solutions for Bitcoin Inheritance

Beyond legal documents, Bitcoin’s programmable nature enables technical solutions that can enhance your inheritance plan. These approaches leverage Bitcoin’s native capabilities to create secure, trustless inheritance mechanisms.

Multisignature Wallets: Shared Control and Security

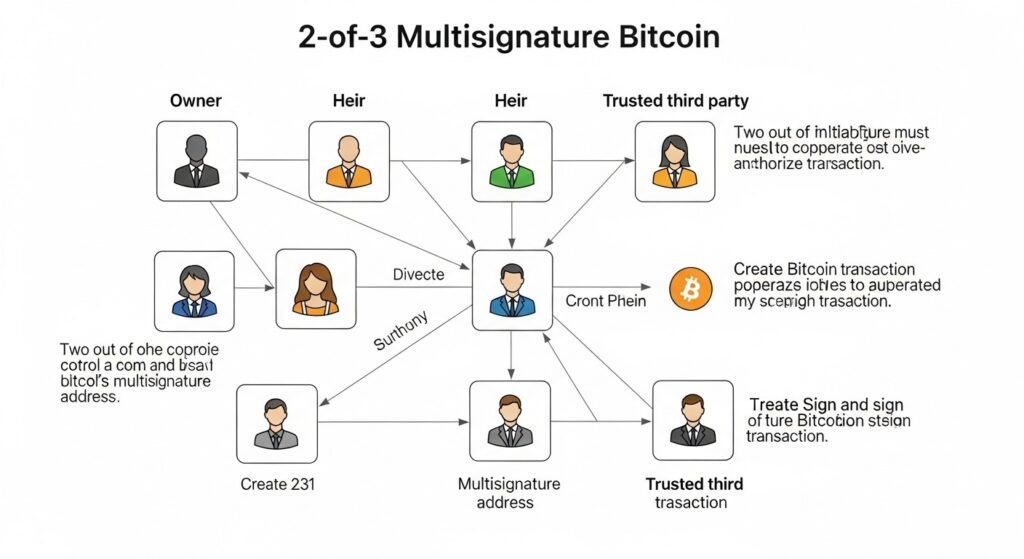

Multisignature (multisig) wallets require multiple private keys to authorize transactions, creating a powerful inheritance tool:

A common inheritance-focused multisig setup is a 2-of-3 configuration where:

- You hold one key for normal transactions during your lifetime

- Your heir holds a second key (but cannot access funds alone while you’re alive)

- A trusted third party (attorney, service provider) holds the third key

This arrangement provides several advantages:

- Prevents single points of failure

- Creates redundancy if one key is lost

- Allows heirs to access funds with the third party’s help

- Protects against unauthorized access by requiring multiple keys

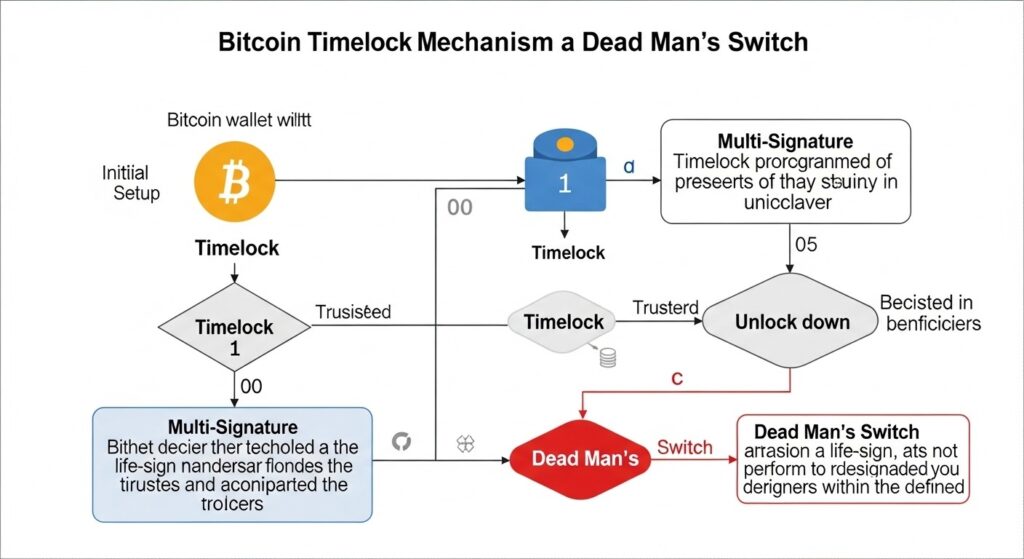

Timelocks: Programmable Inheritance Conditions

Bitcoin’s scripting language allows for time-based conditions using timelocks, which can be powerful inheritance tools:

Absolute Timelocks (CHECKLOCKTIMEVERIFY)

These prevent spending Bitcoin until a specific date or block height. For inheritance planning, you could create a transaction that:

- Becomes valid only after a specific future date

- Transfers funds to your heir’s address automatically

- Serves as a “dead man’s switch” if not cancelled periodically

Relative Timelocks (CHECKSEQUENCEVERIFY)

These create time-based conditions relative to when a transaction is included in a block. For inheritance, you could:

- Create a delayed recovery path for heirs

- Implement a waiting period before funds can be moved

- Combine with multisig for additional security layers

Technical Warning: Timelock solutions require ongoing maintenance and technical expertise. If implemented incorrectly, they could result in permanently locked funds or premature access. Consider working with a Bitcoin inheritance specialist when implementing these advanced solutions.

Specialized Bitcoin Inheritance Platforms

Several platforms have developed specialized solutions for Bitcoin inheritance planning, combining technical and legal approaches to create comprehensive inheritance systems.

Unchained Capital

Approach: Collaborative custody model combining multisig technology with legal integration.

Key Features:

- Vault inheritance planning with legal documentation

- 3-of-5 multisig with distributed key management

- Attorney network familiar with Bitcoin inheritance

- Non-technical heir support and guided recovery

Best For: US-based Bitcoin holders seeking a legally integrated solution with professional support.

Nunchuk

Approach: Non-custodial inheritance solution with flexible control options and strong privacy focus.

Key Features:

- Inheritance-specific multisig configurations

- Time-locked activation options

- Global availability without jurisdictional limitations

- Private by design with minimal data collection

Best For: Privacy-conscious users seeking flexible inheritance options without geographic restrictions.

Liana

Approach: Advanced trustless inheritance using on-chain timelocks with multiple recovery paths.

Key Features:

- Native Bitcoin timelock script implementation

- Primary and recovery spending paths

- Customizable time parameters for inheritance

- Open-source codebase for transparency

Best For: Technically proficient Bitcoin users seeking a trustless, on-chain inheritance solution.

| Platform | Custody Model | Technical Complexity | Legal Integration | Privacy Level | Geographic Availability |

| Unchained Capital | Collaborative | Medium | High | Medium | US Only |

| Nunchuk | Non-custodial | Medium-High | Medium | High | Global |

| Liana | Trustless | High | Low | Very High | Global |

Need Help Choosing the Right Bitcoin Inheritance Solution?

Our AI-powered advisory service can analyze your specific situation and recommend the optimal inheritance strategy based on your technical comfort level, privacy requirements, and legal jurisdiction.

Legal and Tax Considerations for Bitcoin Inheritance

Bitcoin inheritance involves navigating complex legal and tax landscapes that vary significantly by jurisdiction. Understanding these considerations is essential for creating an effective inheritance plan.

Legal Recognition of Bitcoin as Property

Most jurisdictions classify Bitcoin as property rather than currency, but specific definitions vary:

- United States: The IRS classifies Bitcoin as property, subject to capital gains tax and estate tax

- European Union: Varies by country, but generally treated as a digital asset or intangible property

- United Kingdom: Classified as property by the UK Jurisdiction Taskforce

- Japan: Legally recognized as a payment method with property characteristics

- Singapore: Considered intangible property with specific cryptocurrency regulations

Cross-Border Inheritance Challenges

Bitcoin’s borderless nature creates unique challenges for international inheritance:

Cross-Border Complexity: If you have heirs in different countries or hold Bitcoin across multiple jurisdictions, your inheritance plan must account for potentially conflicting inheritance laws, tax treaties, and reporting requirements.

Tax Implications of Bitcoin Inheritance

Tax treatment of inherited Bitcoin varies significantly by jurisdiction:

| Country | Estate/Inheritance Tax | Capital Gains Treatment | Key Considerations |

| United States | 40% federal estate tax above exemption ($12.92M in 2023) | Stepped-up basis to fair market value at death | State-level inheritance taxes may apply additionally |

| United Kingdom | 40% above £325,000 threshold | No CGT on death; new acquisition cost for heirs | Spouse exemptions and residence nil-rate band available |

| Germany | 7-50% depending on relationship and amount | Tax-free after 1-year holding period | Personal exemptions vary by relationship to deceased |

| Japan | 10-55% progressive rates | Acquisition cost carries over to heirs | High rates with relatively low exemptions |

| Singapore | No inheritance or estate tax | No capital gains tax | One of the most tax-favorable jurisdictions |

Tax Planning Tip: Consider consulting with a cryptocurrency-savvy tax professional to explore strategies like lifetime gifting, trust structures, or jurisdictional planning that may reduce the tax burden on your Bitcoin inheritance.

Practical Steps to Create Your Bitcoin Inheritance Plan

Creating an effective Bitcoin inheritance plan requires a systematic approach that combines technical, legal, and educational elements. Follow these steps to develop a comprehensive plan.

1. Create a Comprehensive Bitcoin Inventory

Begin by documenting all your Bitcoin holdings:

- List all Bitcoin wallets (hardware, software, paper) and their approximate values

- Document any exchange accounts or custodial services holding your Bitcoin

- Record the locations of hardware wallets, backup devices, and seed phrases

- Create a separate secure document with access instructions (never in your will)

Security Note: Store your inventory document securely, separate from your actual keys or seed phrases. Consider encrypted storage with a password known to your attorney or trusted advisor.

2. Assess Your Technical and Security Setup

Evaluate your current Bitcoin storage approach for inheritance-readiness:

- Review your current security model (single-key, multisig, hardware, software)

- Identify single points of failure that could prevent inheritance

- Consider implementing multisignature or timelock solutions if appropriate

- Ensure you have adequate backups of all critical information

3. Create Legal Documentation

Establish the legal framework for your Bitcoin inheritance:

- Work with an attorney familiar with digital assets to update your will or trust

- Specify Bitcoin assets in your estate documents (without including keys)

- Designate technically competent executors or trustees if possible

- Consider jurisdiction-specific requirements for digital assets

4. Develop Detailed Access Instructions

Create clear, step-by-step instructions for accessing your Bitcoin:

- Write instructions assuming zero technical knowledge

- Include screenshots, wallet software locations, and recovery procedures

- Explain multisig requirements or timelock mechanisms if used

- Store these instructions securely, separate from your will

5. Educate Your Heirs

Prepare your beneficiaries to handle their inheritance:

- Provide basic Bitcoin education to designated heirs

- Explain the importance of security and private key management

- Consider a “practice run” with a small amount of Bitcoin

- Introduce them to trusted advisors who can assist if needed

6. Implement Regular Review and Updates

Ensure your plan remains current and effective:

- Schedule annual reviews of your Bitcoin inheritance plan

- Update after significant life events or changes in holdings

- Verify that technical solutions still function as intended

- Adjust for changes in technology, laws, or tax regulations

Need a Customized Bitcoin Inheritance Plan?

Our team of Bitcoin inheritance specialists can help you create a comprehensive plan tailored to your specific holdings, technical comfort level, and legal jurisdiction.

Common Bitcoin Inheritance Mistakes to Avoid

Even well-intentioned Bitcoin inheritance plans can fail due to common mistakes. Being aware of these pitfalls can help you create a more robust plan.

Security Mistakes

- Including private keys in wills – Exposes keys to public record during probate

- Single points of failure – Relying on one device, location, or person

- Inadequate backups – Failing to secure recovery information in multiple locations

- Overcomplicating security – Creating systems too complex for heirs to navigate

Legal Mistakes

- Ignoring jurisdictional issues – Not accounting for cross-border complications

- Outdated documentation – Failing to update plans after acquiring new assets

- Choosing inappropriate fiduciaries – Selecting executors without technical knowledge

- Neglecting tax planning – Creating unexpected tax burdens for heirs

Communication Mistakes

- Insufficient heir education – Not preparing beneficiaries to handle Bitcoin

- Unclear instructions – Leaving confusing or incomplete access information

- No contingency planning – Failing to account for various scenarios

- Keeping plans completely secret – Ensuring no one knows assets exist

“The most sophisticated Bitcoin security system in the world is worthless if your heirs don’t know it exists or can’t figure out how to access it. Balance security with accessibility and education.”

Frequently Asked Questions About Bitcoin Inheritance

Can my spouse access my Bitcoin if I die without a plan?

Without a specific inheritance plan, your spouse would have no automatic way to access your Bitcoin unless they already know your private keys or seed phrases. Unlike bank accounts, there is no “next of kin” process for Bitcoin. Even if they legally inherit your assets through intestacy laws, they would still need the technical means to access the Bitcoin wallets or accounts.

How do timelocks prevent heirs from squandering funds?

Timelocks can be programmed to release Bitcoin gradually over time rather than all at once. For example, you could create a series of timelock transactions that release a portion of the inheritance annually or when the heir reaches certain ages. This prevents immediate access to the entire inheritance and provides time for the heir to develop responsible management practices.

What happens to Bitcoin held on exchanges after death?

Bitcoin held on exchanges follows that exchange’s specific policies for deceased users. Typically, heirs must provide a death certificate, proof of their identity, and legal documentation showing their right to inherit the assets. Each exchange has different requirements and processes, which can be time-consuming. Some exchanges may freeze accounts for extended periods during this process, which is why self-custody is generally preferred for inheritance planning.

Can I use a dead man’s switch for Bitcoin inheritance?

Yes, a dead man’s switch—a system that activates when you fail to perform regular check-ins—can be used for Bitcoin inheritance. These can be implemented through specialized services or using Bitcoin’s native timelock features. However, they require careful setup to avoid false triggers (if you simply forget to check in) or technical failures. They work best as part of a comprehensive plan rather than as the sole inheritance mechanism.

How do I handle Bitcoin inheritance across different countries?

Cross-border Bitcoin inheritance requires addressing multiple legal systems. Consider creating a separate inheritance plan for each jurisdiction where you or your heirs reside. Work with attorneys familiar with international estate planning and the specific countries involved. Some strategies include using international trusts, establishing clear domicile for digital assets, and understanding tax treaties between relevant countries to minimize double taxation.

Securing Your Bitcoin Legacy: Next Steps

Creating a robust Bitcoin inheritance plan requires balancing technical security, legal considerations, and practical accessibility. By combining traditional estate planning tools with Bitcoin-specific solutions, you can ensure your digital assets remain both secure during your lifetime and accessible to your heirs afterward.

Remember that the most effective inheritance plans are comprehensive, regularly updated, and include both technical and educational components. Your heirs should not only receive your Bitcoin but also understand how to secure and manage it responsibly.

Ready to Secure Your Bitcoin Legacy?

Our AI-powered advisory service provides personalized Bitcoin inheritance planning tailored to your specific situation, technical comfort level, and legal jurisdiction. Get expert guidance on creating a comprehensive plan that protects your digital assets and ensures they reach your intended beneficiaries.