Your Bitcoin wallet is like a personal vault in the digital realm. It doesn’t actually store your Bitcoin—rather, it safeguards the private keys that give you access to your assets on the blockchain. Choosing the right bitcoin wallet is perhaps the most critical decision you’ll make in your cryptocurrency journey, as it directly impacts both the security of your funds and your ability to use them effectively. Whether you’re securing a few dollars or a significant portion of your wealth, this guide will help you navigate the options and find the perfect balance between security and convenience.

Understanding Bitcoin Wallet Fundamentals

Before diving into specific wallet types, it’s essential to understand what a Bitcoin wallet actually does. Despite the name, these tools don’t physically store your Bitcoin. Instead, they secure the cryptographic keys that prove your ownership and allow you to interact with the Bitcoin network.

Public and Private Keys

Every Bitcoin wallet manages two critical pieces of information:

- Public Key: Acts as your wallet address, which others can use to send you Bitcoin (similar to an email address)

- Private Key: The secret code that allows you to access and send your Bitcoin (similar to a password, but with far greater security implications)

Seed Phrases

Most modern wallets use a recovery seed phrase—typically 12 or 24 random words—that serves as a master key. This seed phrase can regenerate all your private keys if your wallet is lost or damaged, making it absolutely critical to store securely.

Warning: Never share your private keys or seed phrase with anyone. Anyone who has access to these can take control of your Bitcoin.

Hot Wallets: Convenience for Everyday Use

Hot wallets are software applications that remain connected to the internet. They offer quick access to your Bitcoin and are ideal for frequent transactions and smaller amounts. Most are free to download and use, making them an accessible entry point for new users.

Best Use Case: Daily spending and active trading with small to moderate amounts ($1-$300)

Cost Range: Free to $50 (one-time or subscription)

Top Hot Wallet Options

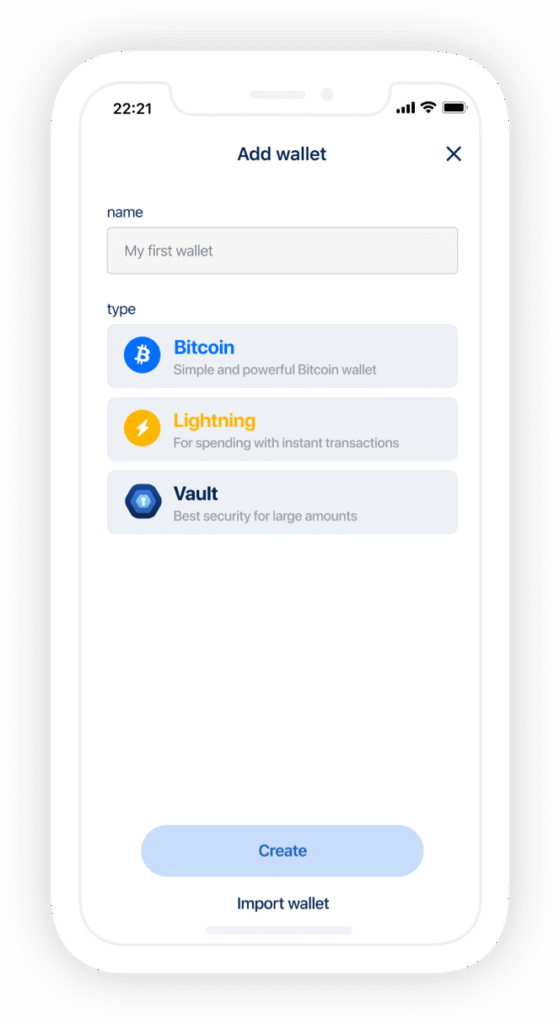

BlueWallet

A mobile-focused Bitcoin wallet with an intuitive interface and advanced features.

- Lightning Network support for faster, cheaper transactions

- Multi-signature wallet capability for enhanced security

- Watch-only wallets to monitor balances without private keys

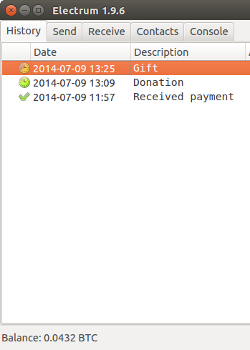

Electrum

A lightweight, feature-rich desktop wallet for more technical users.

- Advanced fee controls for transaction optimization

- Hardware wallet integration for cold storage

- Robust security features including 2FA and seed verification

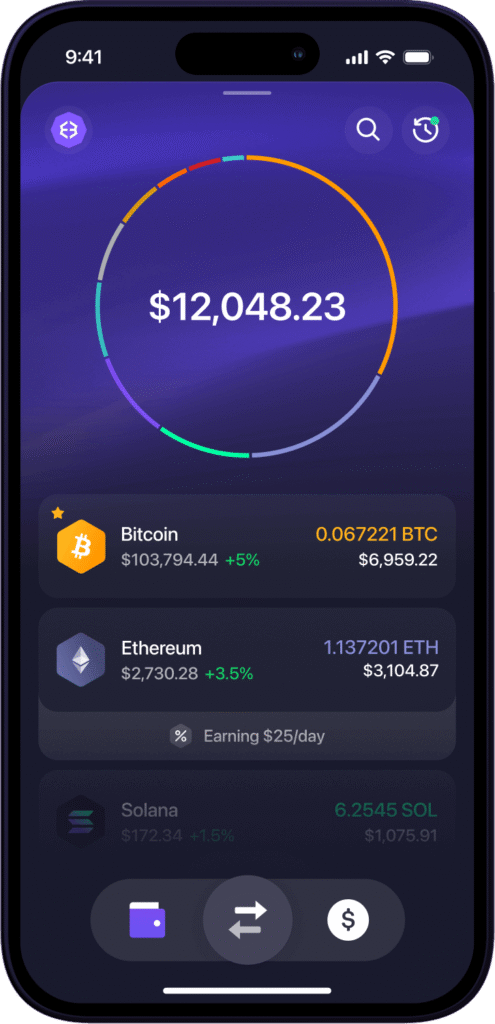

Exodus

A beautifully designed multi-currency wallet with built-in exchange features.

- Support for 100+ cryptocurrencies beyond Bitcoin

- Built-in exchange for swapping between assets

- Desktop and mobile versions with seamless synchronization

“Hot wallets are like having cash in your pocket—convenient for daily use, but you wouldn’t keep your life savings there.”

Hardware Wallets: The Gold Standard for Security

Hardware wallets are physical devices that store your private keys offline, dramatically reducing the risk of remote attacks. They connect to your computer or smartphone only when you need to make a transaction, keeping your keys isolated from internet-connected devices at all other times.

Best Use Case: Savings and long-term holdings ($300-$75,000)

Cost Range: $50-$300 (one-time purchase)

Top Hardware Wallet Options

Trezor

A pioneer in the hardware wallet space with an emphasis on open-source security.

- Open-source firmware that can be verified by anyone

- Easy-to-use interface with clear transaction verification

- Support for 1,000+ cryptocurrencies beyond Bitcoin

Coldcard

A Bitcoin-only hardware wallet designed for maximum security and air-gapped operation.

- True air-gapped functionality using MicroSD cards

- Specialized for Bitcoin with advanced features for power users

- Tamper-evident design with secure element chip

Passport

A modern Bitcoin-focused hardware wallet with emphasis on simplicity and security.

- QR code-based air-gapped transactions

- Purpose-built for Bitcoin with simplified interface

- Durable metal construction for physical resilience

Pro Tip: Always purchase hardware wallets directly from the manufacturer or authorized resellers to avoid tampered devices. Never use a device that comes with a pre-configured seed phrase.

Multi-signature Wallets: Enterprise-Grade Security

Multi-signature (multi-sig) wallets require multiple private keys to authorize a transaction, similar to a bank vault that needs several keys to open. This distributed security model eliminates single points of failure and provides institutional-grade protection for significant Bitcoin holdings.

Best Use Case: Significant assets and institutional holdings ($75,000+)

Cost Range: $150-$3,000/year (subscription services)

Top Multi-signature Service Providers

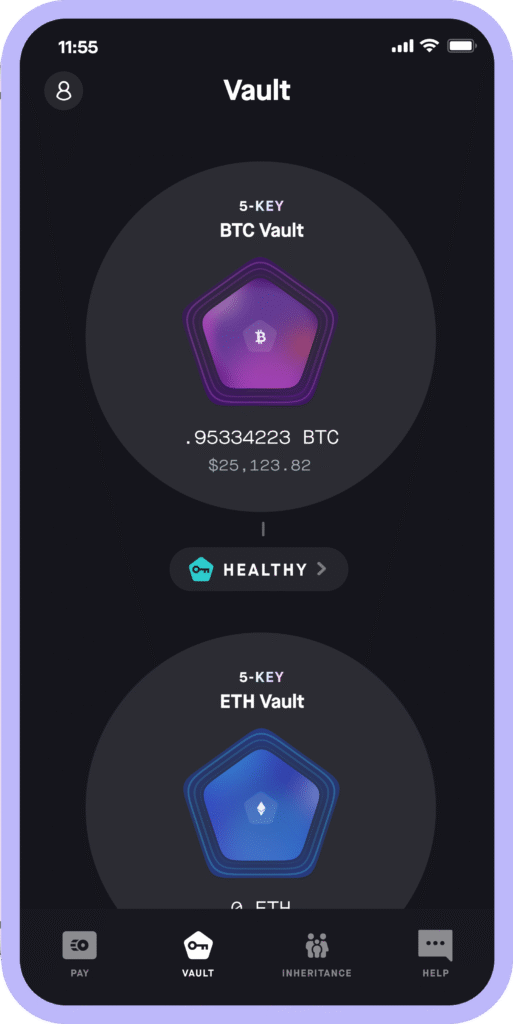

Casa

A premium key management solution with client service and inheritance planning.

- 2-of-3 and 3-of-5 key configurations with geographic distribution

- Guided setup with dedicated client advisors

- Inheritance protocol for estate planning

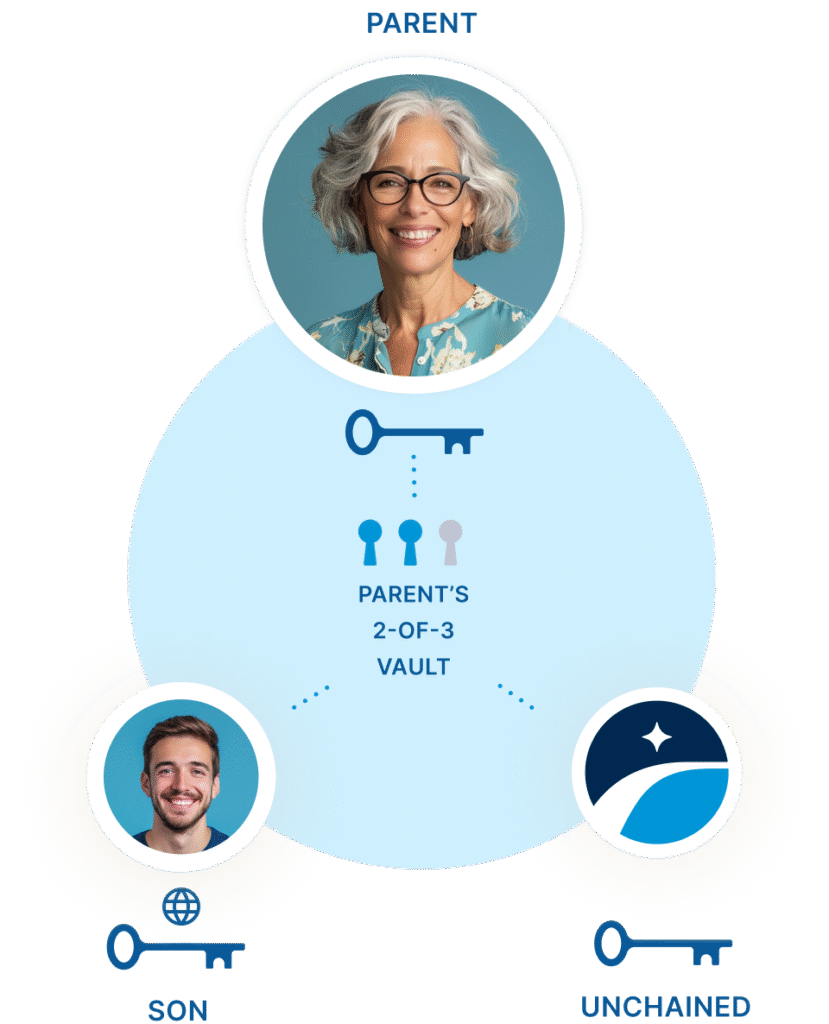

Unchained Capital

A collaborative custody platform combining self-custody with institutional support.

- 2-of-3 multi-signature vaults with institutional key backup

- Loan services using Bitcoin as collateral

- Business accounts for corporate treasury management

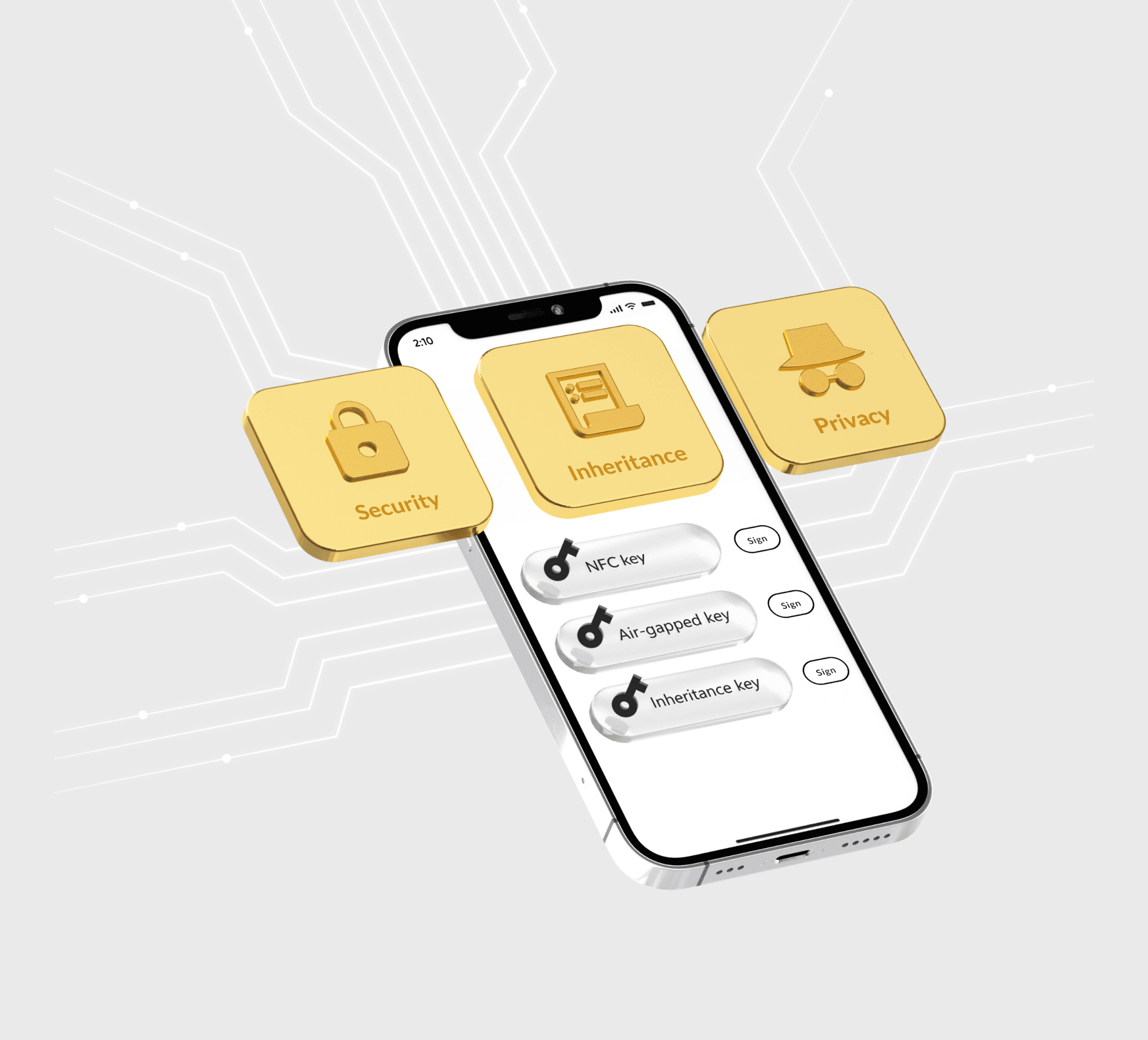

Nunchuk

A collaborative multi-signature platform with powerful team coordination features.

- Flexible multi-signature configurations (m-of-n)

- Team-based approval workflow for organizations

- Open-source software with enterprise support options

“Multi-signature is to Bitcoin security what two-factor authentication is to online accounts, but exponentially more powerful.”

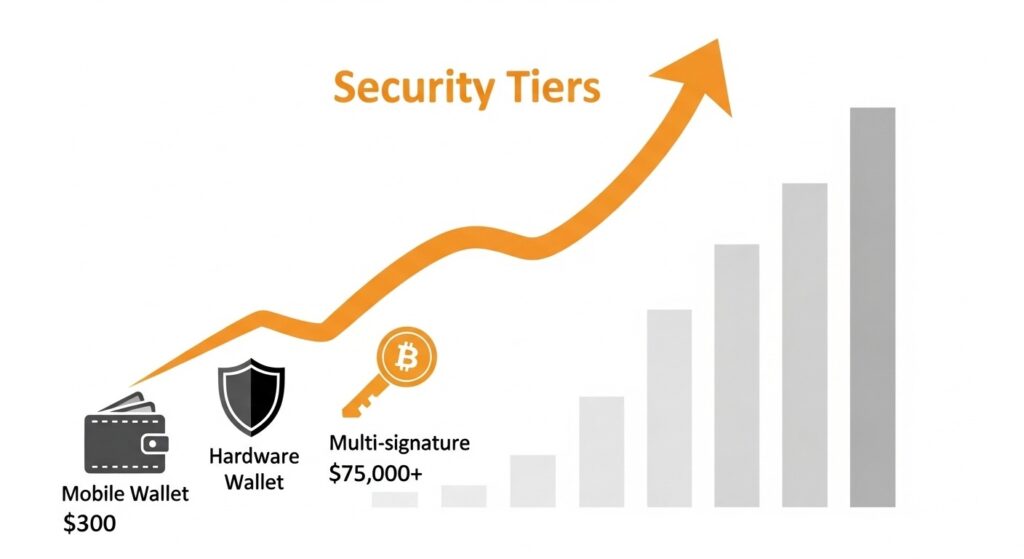

Recommended Security Tiers: Matching Protection to Value

The level of security you need should scale with the value of Bitcoin you’re protecting. This tiered approach helps you implement appropriate security measures without unnecessary complexity for smaller amounts.

| Asset Range | Recommended Setup | Security Features | Convenience Level |

| $1-$300 (Spending Funds) | Mobile Wallet | 2FA, biometric authentication, PIN code | High |

| $300-$10,000 (Savings) | Single Hardware Wallet | Offline private keys, PIN protection, passphrase | Medium |

| $10,000-$75,000 (Long-term Holdings) | Hardware Wallet + Enhanced Backup (Metal seed storage) | Offline keys, PIN, passphrase, fireproof/waterproof seed backup | Low |

| $75,000+ (Significant Assets) | Multi-signature Setup (2-of-3 or 3-of-5) | Distributed key management, geographic separation, inheritance planning | Enterprise |

Pro Tip: Consider implementing a “tiered wallet strategy” where you keep small amounts in more accessible wallets for regular use, while securing larger holdings with progressively stronger security measures.

Critical Backup Strategies

Your backup strategy is just as important as your wallet choice. Even the most secure wallet becomes worthless if you lose access to your recovery information.

Seed Phrase Protection

- Metal Backups: Engrave or stamp your seed phrase on corrosion-resistant metal plates that can survive fire, water, and physical damage

- Geographic Distribution: Store backup copies in multiple secure locations to protect against localized disasters

- Avoid Digital Storage: Never store seed phrases in digital formats (photos, text files, cloud storage) that can be hacked

Testing Your Recovery

Regularly verify that your backup system works by testing the recovery process:

- Practice recovering a small test wallet before committing significant funds

- Periodically check physical backups for degradation or damage

- Document recovery procedures for trusted family members in case of emergency

Warning: More Bitcoin has been lost due to poor backup practices than has ever been stolen through hacks. Never skip this critical step.

Common Wallet Selection Mistakes to Avoid

Best Practices

- Matching wallet security to asset value

- Using hardware wallets for significant holdings

- Creating secure, redundant backups

- Verifying software authenticity

- Testing recovery procedures before full deployment

Common Mistakes

- Keeping large amounts on exchanges

- Using unverified wallet applications

- Storing seed phrases digitally

- Overcomplicating security for small amounts

- Failing to test recovery procedures

The most secure wallet setup is one that you can confidently use without making mistakes. Finding the right balance between security and usability is key to successful long-term Bitcoin storage.

Decision Guide: Finding Your Ideal Wallet

Use these questions to guide your wallet selection process:

How frequently will you access your Bitcoin?

Daily/Weekly: Consider a hot wallet for convenience

Monthly/Yearly: A hardware wallet provides better security for less frequent access

Rarely (long-term holding): Consider enhanced hardware wallet setups or multi-signature solutions

What value of Bitcoin will you store?

Small ($1-$300): Mobile wallet with basic security is sufficient

Medium ($300-$10,000): Hardware wallet recommended

Large ($10,000-$75,000): Hardware wallet with enhanced backup solutions

Significant ($75,000+): Multi-signature setup with distributed keys

What is your technical comfort level?

Beginner: User-friendly options like Exodus or BlueWallet

Intermediate: Hardware wallets like Trezor with guided setup

Advanced: Specialized options like Coldcard or multi-signature setups

Professional: Custom configurations with service provider support

Master Bitcoin Self-Custody

Ready to Become a Bitcoin Self-Custody Expert?

Take your Bitcoin security knowledge to the next level with the “Custody Agents” podcast. Join our experts as they dive deep into advanced self-custody strategies, multi-signature implementations, and the path to true financial sovereignty.

Conclusion: Your Path to Bitcoin Security

Choosing the right bitcoin wallet is a personal decision that depends on your specific needs, technical comfort level, and the value of assets you’re protecting. By understanding the tradeoffs between different wallet types and implementing appropriate security measures for your holdings, you can confidently participate in the Bitcoin ecosystem while maintaining control of your digital assets.

Remember that security is a journey, not a destination. As your Bitcoin holdings grow in value, be prepared to upgrade your security practices accordingly. The time invested in learning proper self-custody techniques is perhaps the highest-yielding investment you can make in your Bitcoin journey.

This is my first time pay a visit at here and i am genuinely impressed to read everthing

at one place.